Small Business Tech Faces Funding, Compliance, and AI Return Challenges

Explore the latest trends in small business technology and innovation, covering government funding, federal contracting program shifts, and the emerging GenAI Divide as of January 29.

One Of The Best Businesses To Start In 2026

AI Trends 2026: Quantum, Agentic AI & Smarter Automation

6 BRAND NEW Digital Marketing Trends for 2025

In the dynamic landscape of small business technology and innovation, recent developments highlight both significant opportunities and pressing challenges. From substantial government investments aimed at bolstering supply chains to critical shifts within federal contracting programs and the nascent, yet concerning, 'GenAI Divide,' the small business sector is navigating a complex technological evolution. These insights, curated as of January 29, offer a snapshot of the forces shaping entrepreneurial ventures today.

Government Funding Spurs Sectoral Innovation

A notable injection of capital from the Department of Energy is poised to catalyze innovation across several vital sectors. A total of $155 million has been allocated to fund 16 distinct projects. These initiatives are specifically designed to foster technological advancements in areas crucial to the economy, including cement production and the food industry. The overarching goal of this significant investment is to enhance supply chains, a move that is expected to yield substantial benefits for small businesses operating within these sectors. By improving efficiency and resilience in these fundamental areas, the funding aims to create a more robust environment for smaller enterprises, enabling them to better compete and grow. This strategic funding underscores a commitment to fortifying foundational industries through technological innovation, with small businesses positioned as key beneficiaries of improved infrastructure and processes, as reported by Forbes.

Shifting Landscape for SBA's 8(a) Contracting Program

The Small Business Administration's (SBA) 8(a) federal contracting program, a critical avenue for minority-owned and disadvantaged small businesses to access government contracts, is currently experiencing a significant contraction. Recent data indicates a sharp downturn in participation, primarily stemming from rigorous compliance enforcement. Approximately 1,000 firms have reportedly been suspended from the program due to various compliance issues. Further exacerbating this trend, only 65 new firms were admitted into the program for Fiscal Year 2025. This marked reduction in participant numbers suggests a tightening of regulations and an elevated focus on adherence to program stipulations. For many small businesses, the 8(a) program provides invaluable opportunities for growth and stability. The current shifts indicate a more selective environment, necessitating a renewed emphasis on robust internal controls and meticulous compliance from participating or aspiring firms. This development could reshape the competitive landscape for federal contracts, pushing businesses to ensure their operations are beyond reproach to maintain eligibility and status.

The Emerging 'GenAI Divide'

Despite a surge of investment and widespread experimentation, a new report highlights a notable "GenAI Divide" within the business world, especially impacting small firms. The data reveals that a staggering 95% of companies piloting Artificial Intelligence (AI) tools are currently seeing no tangible financial return on their investments. This is particularly striking given the substantial capital poured into the technology, estimated to be between $30 billion and $40 billion globally, and the fact that over 80% of companies are actively piloting AI solutions. The lack of demonstrable financial returns points to potential challenges in effective implementation, integration, or perhaps, an overestimation of immediate benefits. For small businesses, which often operate with tighter margins and fewer resources for research and development, this divide presents a critical concern. While the allure of AI promises enhanced efficiency and new capabilities, the initial inability to convert these into financial gains suggests that the journey from pilot to profitability is more complex than anticipated. This trend encourages a cautious but informed approach to AI adoption, emphasizing strategic planning and clear objectives to avoid becoming part of the 95% experiencing no financial upside, as detailed in recent analyses highlighted by Forbes.

Expert Perspectives and Future Trends

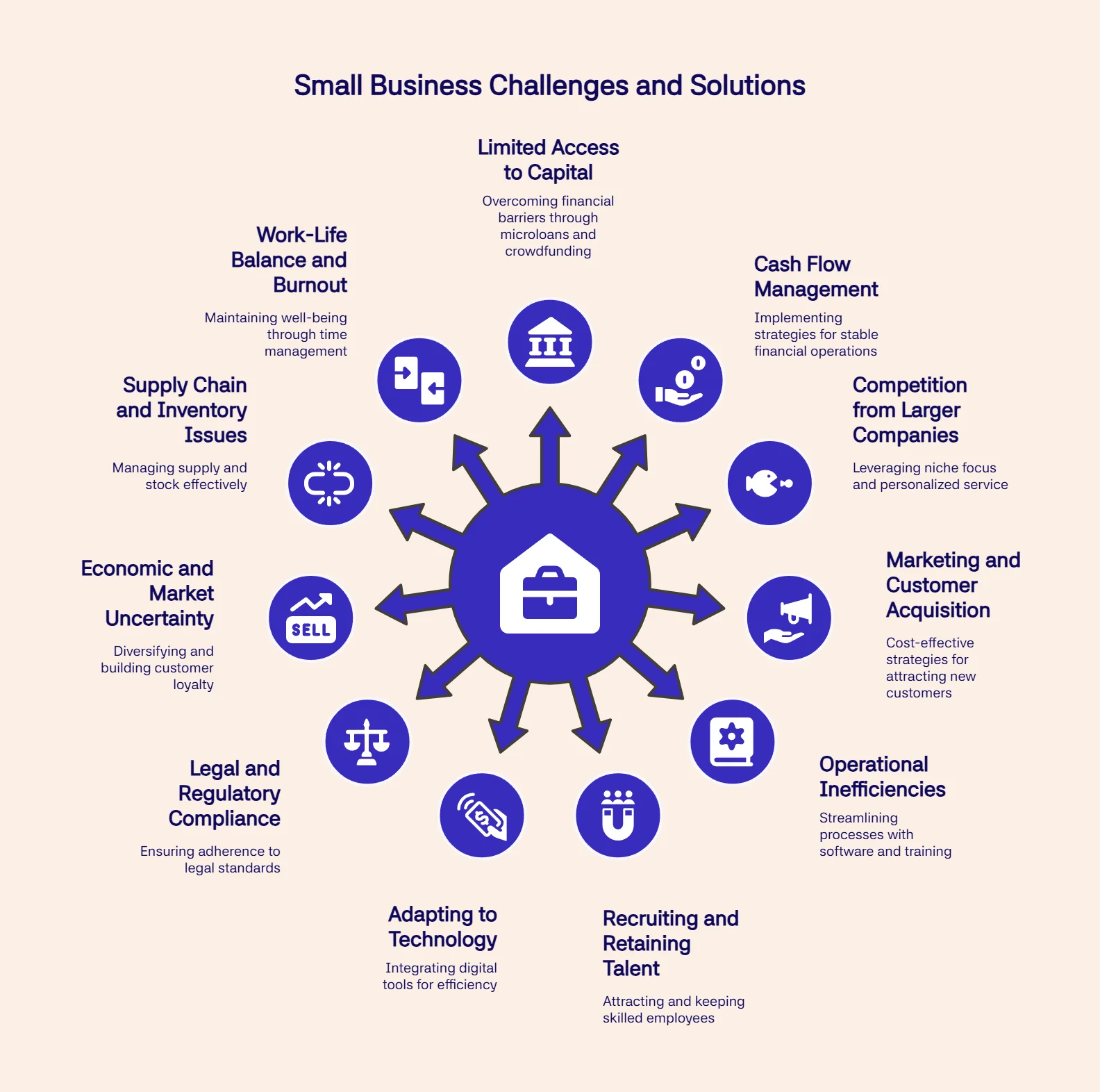

The convergence of these events paints a complex, yet fertile, ground for small business tech and innovation. The Department of Energy's strategic funding demonstrates a governmental recognition of the critical role small businesses play in national infrastructure and supply chain resilience. This positive development is balanced by the challenges presented in federal contracting, where compliance and oversight are becoming increasingly stringent. Firms relying on programs like the 8(a) will need to adapt quickly to these tighter regulations. Moreover, the 'GenAI Divide' serves as a critical warning. While AI holds immense promise, its practical application and financial benefits are not yet universally realized. Small businesses must carefully evaluate their AI strategies, focusing on clear objectives and measurable outcomes to truly benefit from these advanced technologies rather than merely investing without return.

Staying Ahead in a Evolving Landscape

For small business leaders and entrepreneurs, staying informed about these macro trends is paramount. The curated insights provided by platforms like Forbes, powered by AI tools such as Adelaide, offer invaluable perspectives into innovative developments, emerging trends, and expert analyses. Understanding where government support is directed, navigating evolving compliance requirements for contracting, and critically assessing the true return on investment for new technologies like AI will be key determinants of success. The landscape demands adaptability, strategic foresight, and a nuanced understanding of how technological advancements can be effectively leveraged to achieve sustainable growth and competitive advantage in today's rapidly changing economy.

Related Articles

Joby Aviation Stock Tumbles 13% on $1 Billion Capital Raise Plan

Joby Aviation shares dropped significantly after announcing plans to raise $1 billion through stock and convertible note sales, sparking dilution fears among investors.