Analyst Spotlight: Airbnb, ConocoPhillips, Albemarle, Tempus, Upstart Navigate Market Shifts

Top analysts offer varied ratings for Airbnb, ConocoPhillips, Albemarle, Tempus AI, and Upstart Holdings, signaling key market trends and potential shifts.

Top analysts offer varied ratings for Airbnb, ConocoPhillips, Albemarle, Tempus AI, and Upstart Holdings, signaling key market trends and potential shifts.

In a dynamic financial landscape, leading market analysts are scrutinizing a diverse set of companies, offering updated ratings and price targets that reflect shifting market conditions, innovative business strategies, and emerging industry trends. This week's notable movements include renewed optimism for travel giant Airbnb and lithium producer Albemarle, alongside refined expectations for energy stalwart ConocoPhillips. Meanwhile, burgeoning tech firms Tempus AI and Upstart Holdings are capturing attention with their high-growth potential and evolving business models. These shifts highlight a period of significant re-evaluation as companies navigate post-pandemic economic realities, commodity market volatility, and the relentless pace of technological advancement, providing crucial insights for investors tracking sector-specific opportunities and broader market health.

The intricate dance between market sentiment, corporate performance, and analyst recommendations forms the backbone of investment strategy. For investors, understanding the rationale behind these ratings shifts is paramount, as they can signal fundamental changes in a company's outlook or simply reflect re-calibrated expectations within a volatile economic environment. The companies in focus this week represent a cross-section of industries, each grappling with unique challenges and opportunities. From the travel sector's resurgence, exemplified by Airbnb’s strategic initiatives, to the energy market's ongoing recalibrations affecting ConocoPhillips, and the evolving demand for critical materials like lithium driving Albemarle's prospects, these movements are not isolated. They are symptomatic of broader economic forces – inflation, interest rate policies, supply chain dynamics, and geopolitical events – that continuously shape corporate profitability and investor confidence. The emergence of high-growth tech firms like Tempus AI in precision medicine and Upstart Holdings in AI-driven lending further underscores the market's appetite for innovation, even as these ventures carry inherent "speculative risk" as noted by analysts. The current environment, described by TipRanks, suggests a market where detailed company-specific analysis is crucial, moving beyond broad sector trends to identify nuanced value and risk.

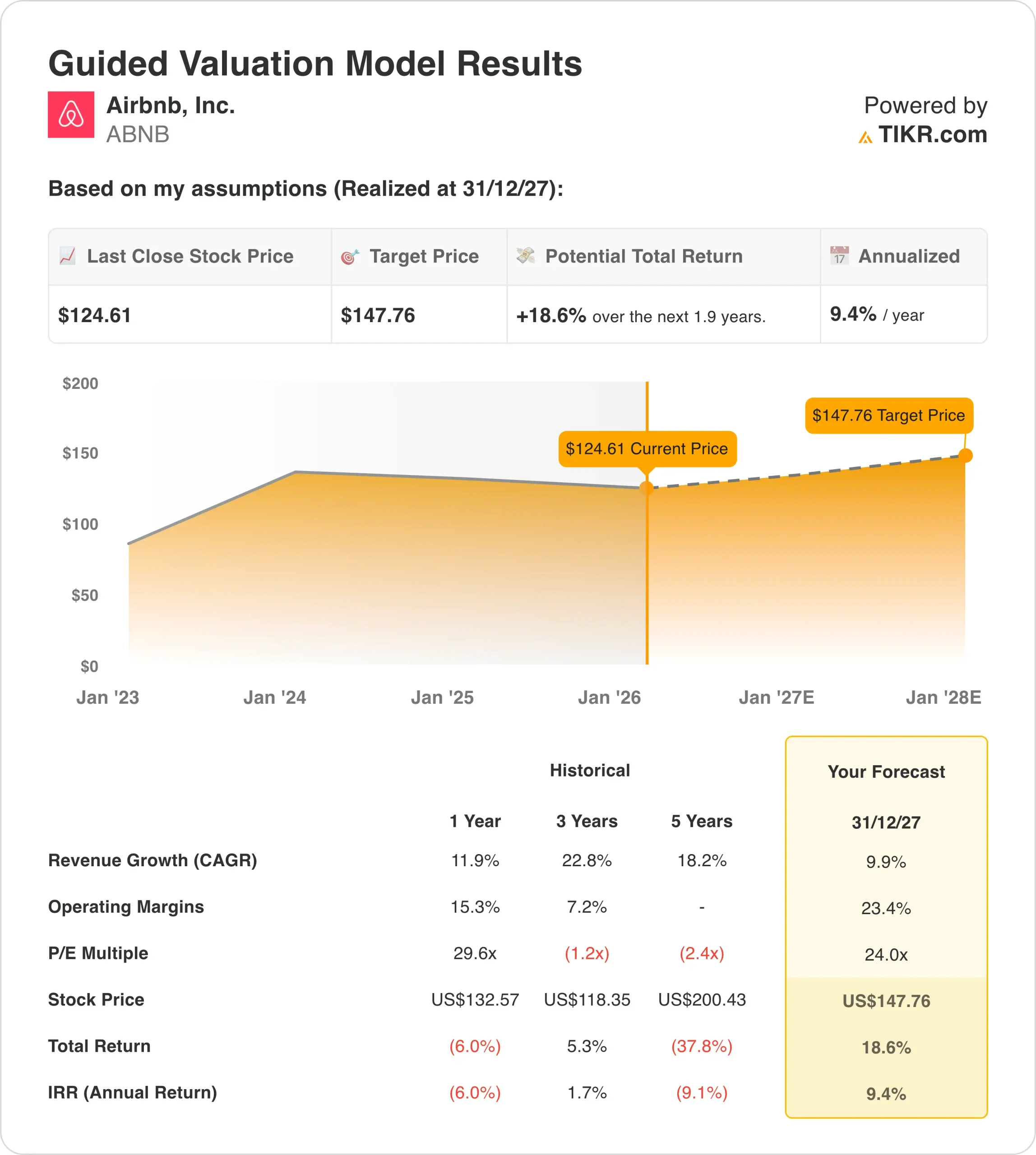

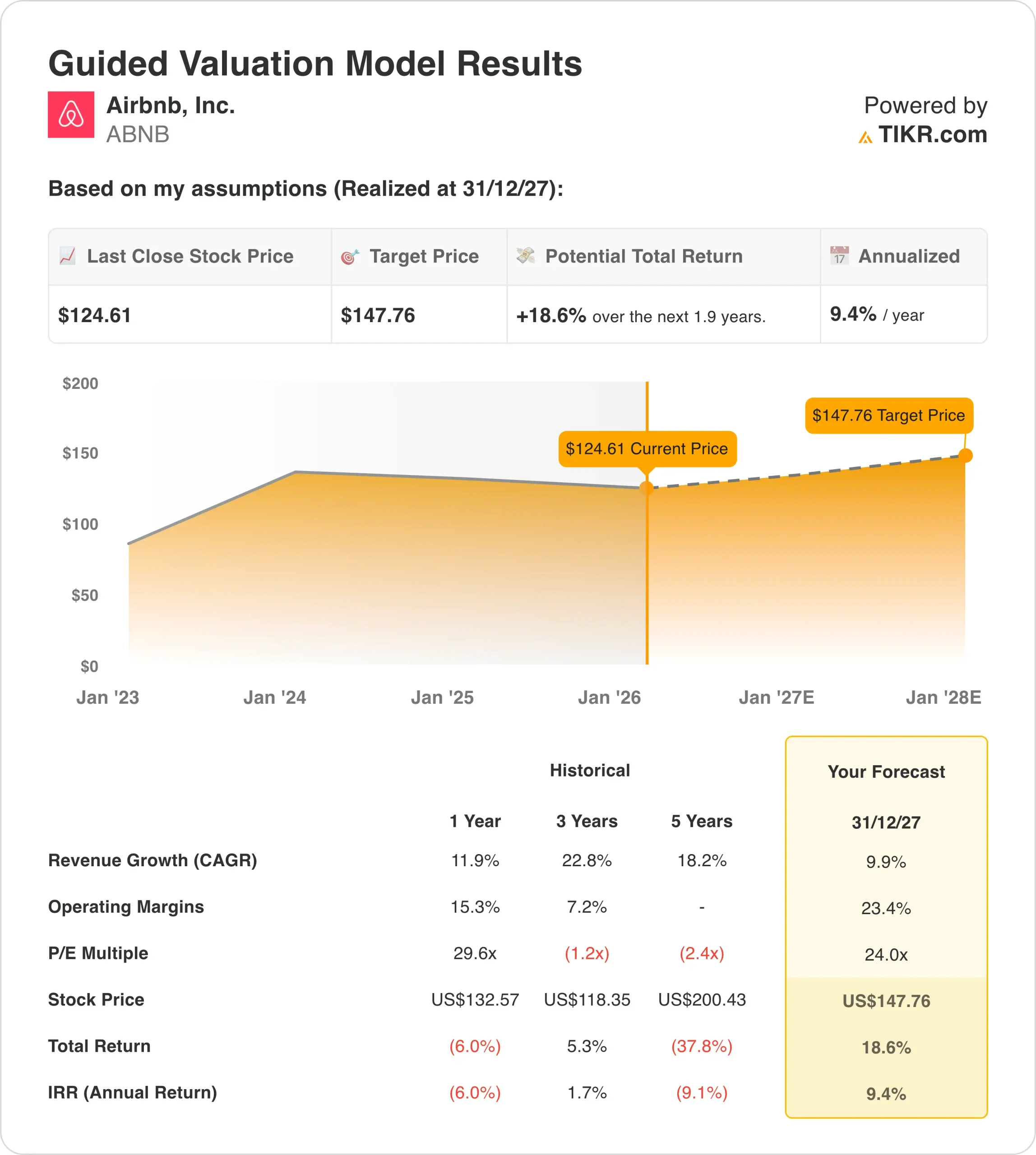

Recent analyst reports highlight significant shifts in investor perception and fundamental outlooks for several key companies. Airbnb is experiencing a resurgence in analyst interest, driven by impressive Q4 revenue growth of 12% and strong average daily rates. Phillip Securities' Paul Chew upgraded Airbnb to a 'Buy' with a $138 target, citing impactful initiatives like "Reserve Now, Pay Later," clearer fee structures, and updated cancellation policies, which are significantly boosting bookings. Further optimism stems from major upcoming events like the Winter Olympics and the 2026 FIFA World Cup, along with robust global expansion in Latin America and Asia Pacific, where nights booked are seeing mid-to-high teen growth. While increased marketing and product investment are temporarily impacting near-term profits, analysts see long-term growth as well-anchored, according to TipRanks.

Conversely, ConocoPhillips has seen a slight cooling of analyst enthusiasm. Leo Mariani downgraded COP to 'Hold,' primarily due to the stock trading at a premium valuation compared to its peers and the belief that global oil prices may be nearing a short-term peak. While acknowledging COP's strengths—including a long inventory life, a low cost of supply (break-even below $50 WTI), a strong balance sheet, and a compelling 3% dividend with 3-4% annual share buybacks—Mariani suggests that much of the future free cash flow growth, including the significant ramp-up from the Willow project in 2029, is already priced into the current valuation. Its present valuation is near his $112 price target, limiting immediate upside, as detailed by TipRanks.

Albemarle is back in favor, with Rock Hoffman upgrading the stock to 'Buy' and setting a new target of $190. This positive shift comes as the lithium market demonstrates "structural healing" beyond mere speculative interest. Critical factors include lithium spot prices holding above $20/kg, coupled with the company's cost-cutting measures and productivity gains, which promise significant earnings leverage. Strong energy storage volumes in their fourth-quarter results, indicating easing destocking pressures, further reinforce this optimistic outlook. Hoffman projects 2026 EBITDA margins to reach approximately 41%, supported by $450 million in existing cost savings and an additional $100–150 million targeted. Regulatory changes in China and robust battery demand are expected to maintain a constructive, albeit volatile, pricing environment for Albemarle’s diverse portfolio. This comprehensive turnaround positions Albemarle favorably, as noted in the TipRanks report.

Tempus AI, a relatively new entrant, has garnered significant attention from analysts as a high-growth play in precision medicine. Baird’s Catherine Ramsey Schulte initiated coverage with a 'Buy (Outperform/Speculative Risk)' rating and a $59 price target. Schulte underscores Tempus’s unique position at the intersection of genomics testing in oncology and an expanding data and services business built on de-identified clinical information. She posits that comprehensive genomic profiling is still underpenetrated, and Tempus is well-positioned for growth as testing expands to earlier disease stages, a wider array of tumor types, and more reimbursed indications. Leveraging rich longitudinal, multimodal datasets and strong relationships with providers and biopharma, Schulte forecasts roughly 17% compound annual revenue growth through 2031, with substantial upside from emerging areas like minimal residual disease testing and AI-driven diagnostics, as highlighted by TipRanks.

Finally, Upstart Holdings is witnessing a positive sentiment shift, as its long-term strategic roadmap provides clearer valuation anchors for investors. Giuliano Bologna upgraded UPST from 'Sell' to 'Hold,' raising his price target to $30. This adjustment follows management’s guidance for an approximate 35% annual revenue growth and about 25% terminal EBITDA margins through 2025–2028, shifting the focus from speculative trading to an earnings-based discussion. While acknowledging execution risks as Upstart scales auto loans and home equity products, Bologna's model suggests that achieving these targets could make the stock’s current multiples on 2028 tangible book and earnings appear conservative. With new leadership anticipated in 2026, projected solid cash build through 2028, and a strategic pivot towards more capital-efficient growth, Upstart is transitioning into a company where future performance, rather than speculative hype, is expected to drive shareholder returns, according to TipRanks.

The aggregate of these analyst movements paints a picture of a market grappling with contradictory forces: the optimism born from post-pandemic recovery and technological innovation versus the sober realities of valuation constraints and commodity market volatility. The upgrades for Airbnb and Albemarle reflect a broader belief in the recovery and structural strength of certain sectors. Airbnb's trajectory suggests that the travel sector, particularly its digital disruptors, has not only rebounded but is actively innovating to capture sustained growth. For Albemarle, the shift indicates a critical turning point for the lithium market, moving from speculative hype to fundamental supply-demand dynamics driven by the burgeoning electric vehicle market. This evolution is vital for investors differentiating between temporary fads and sustainable industry transformations. On the other hand, the downgrade for ConocoPhillips, while acknowledging its inherent quality, underscores the challenge of finding value in an energy sector prone to rapid price shifts and questions about peak valuations. It highlights the principle that even strong companies can be priced to perfection, leaving little room for upside. The initiation of coverage for Tempus AI and the upgraded outlook for Upstart Holdings further exemplify the market's continuous search for next-generation growth stories. These companies represent the cutting edge of AI and big data application in healthcare and finance, sectors ripe for disruption. However, the explicit mention of "speculative risk" for Tempus AI and the focus on "execution risk" for Upstart remind investors that high growth often comes with elevated uncertainty. This dynamic environment necessitates a balanced approach, where investors must weigh the potential for disruptive growth against robust due diligence and an understanding of intrinsic value, reflecting a sophisticated market that is no longer swayed by hype alone but demands clear roadmaps and strong execution.

Beyond the core analyst ratings, the broader market context provides an interesting juxtaposition. While traditional equity markets are seeing nuanced shifts, the cryptocurrency market, as reported by Bitget, is exhibiting surprising stability. Bitcoin, Ethereum, and XRP are holding steady, with Bitcoin consolidating near $68,000, Ethereum around $1,960, and XRP near $1.42. This calm in crypto, particularly Bitcoin's hidden bullish divergence and significant whale accumulation (over 30,000 BTC in a week), suggests strategic positioning rather than passive dormancy, potentially signaling a breakout. Such movements in crypto can influence broader investor sentiment, especially among younger, more tech-savvy investors who often bridge both traditional and digital asset markets. The growing interconnectedness means that significant moves in one arena can subtly impact risk appetite and capital allocation in another, adding another layer of complexity to analyst assessments of tech-oriented companies like Tempus AI and Upstart, which rely heavily on innovation and future growth potential.

In a wholly different vein, the social realities facing entrepreneurs, particularly women, in emerging economies like India, as highlighted by India Today, offer a poignant reminder of the non-financial hurdles to economic development and entrepreneurial success. A Delhi-based female founder shared her struggles with intrusive landlord practices—arbitrary rent hikes, privacy violations, and moral policing—making house hunting harder than building her startup. This narrative, while seemingly disconnected from stock market analysis, sheds light on the socio-economic infrastructure that underpins business environments globally. Such foundational issues illustrate that even as countries celebrate startup ecosystems, underlying societal challenges can impede growth, impacting the human capital crucial for the very innovations that analysts often laud. This serves as a stark reminder that market performance is not solely a function of corporate strategy or global economic trends, but also of the enabling or disabling social and regulatory environments in which businesses operate.

The coming months will be crucial for validating the refreshed analyst perspectives on these trending stocks. For Airbnb, continued expansion into new markets and the successful execution of high-profile events will be key indicators of sustained growth. Investors will keenly watch for signs that the increased marketing and product investments translate into long-term market share gains and profitability. For ConocoPhillips, the trajectory of global oil prices and any adjustments to production forecasts will dictate whether the current "Hold" rating holds firm or shifts. The market will also be observing the progress of the Willow project and how its future contributions are reflected in the stock's valuation. Albemarle's performance will be heavily tied to continued stability and growth in lithium spot prices, along with the successful implementation of its targeted cost savings. Progress in expanding its portfolio and navigating regulatory shifts in key markets like China will also be under scrutiny. Tempus AI, as a high-growth speculative play, will need to demonstrate consistent progress in expanding its genomic testing services, particularly into new disease stages and reimbursed indications. Any advances in AI-driven diagnostics will be vital for justifying its lofty growth projections. Finally, Upstart Holdings faces the challenge of executing its ambitious 2025–2028 guidance, particularly as it expands into auto loans and home equity products. The transition to new leadership in 2026 and its pivot towards capital-efficient growth will be critical elements to watch, as investors seek concrete evidence that its long-term roadmap can translate into tangible shareholder returns.

Agentic AI is transforming core enterprise infrastructure, generating 80% of databases, shifting companies to Large Action Models, and laying groundwork for an agent-first web.

Prince Andrew has been arrested on suspicion of misconduct in public office, tied to his relationship with Jeffrey Epstein, leading to swift, widespread reactions and a wave of internet memes.

Prince Andrew arrested on misconduct charges related to Epstein, sparking widespread trending memes despite the gravity of allegations.