US Dollar's Sharp Decline: Viral Chart Sparks Widespread Economic Concerns

A new viral chart depicting a rapid drop in the US dollar's value is raising alarms among financial experts and policymakers, hinting at broader economic instability and reduced American purchasing power.

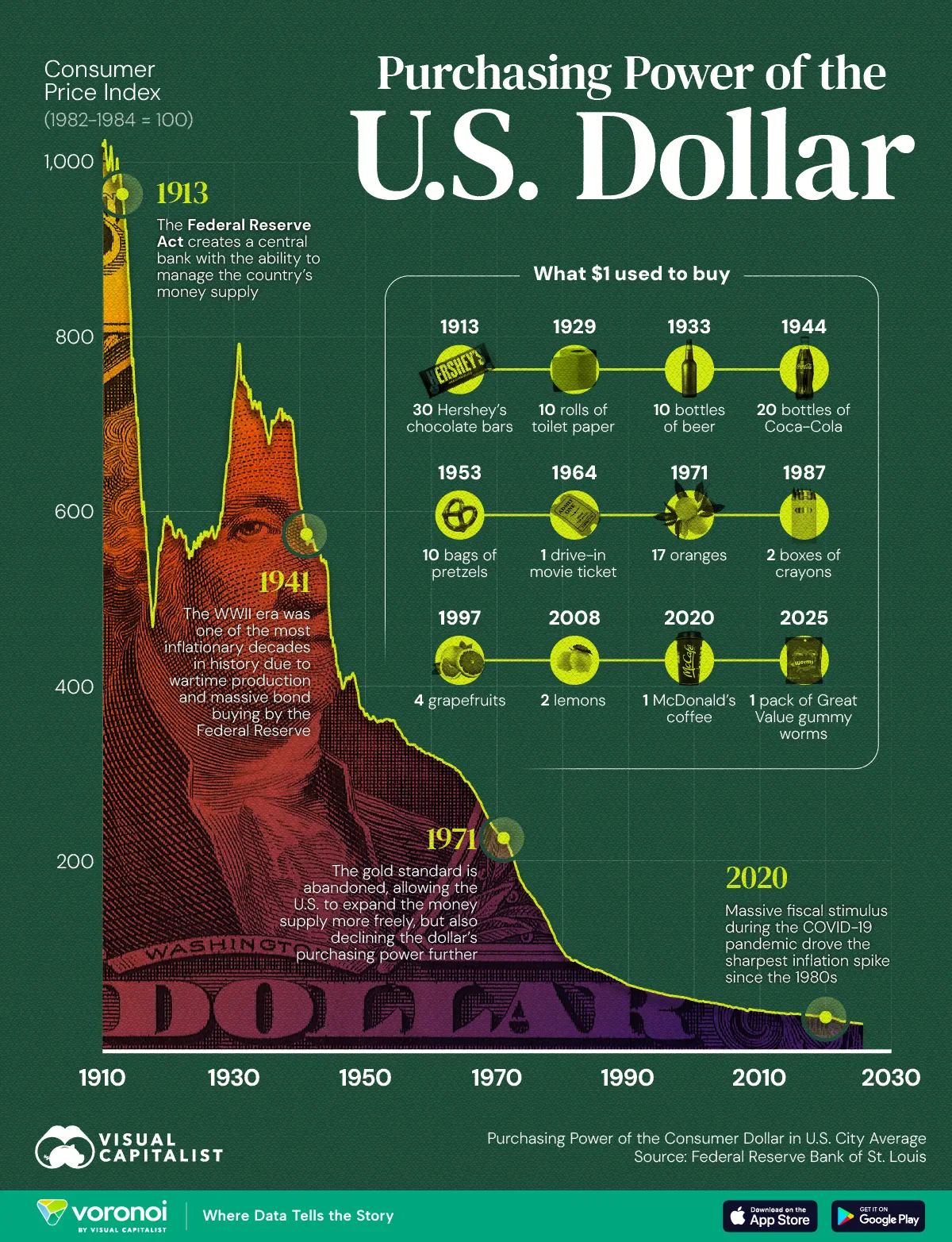

A recently surfaced chart illustrating a rapid decline in the US dollar's value has gone viral online, igniting considerable concern among financial observers and the public alike. The chart, widely shared across social media platforms, appears to underscore burgeoning economic uncertainties within the United States. This development has prompted various experts to weigh in on the potential ramifications for American purchasing power, international trade, and the nation's financial stability.

The Dollar Index and its Significance

The US dollar index (DXY) serves as a crucial barometer, measuring the dollar's strength against a basket of currencies belonging to its primary trading partners. These include the euro (EUR), Japanese yen (JPY), Canadian dollar (CAD), British pound sterling (GBP), Swedish krona (SEK), and Swiss franc (CHF). Fluctuations in this index offer insights into the dollar's valuation, which in turn can significantly influence various aspects of the economy, such as the cost of imports and exports, domestic prices, and overall economic health. A weakening dollar, for instance, typically makes imports more expensive and can fuel inflation, while potentially making US exports more competitive globally.

Viral Chart Highlights Swift Decline

The chart that has garnered widespread attention was initially posted on the social media platform X (formerly Twitter) on Sunday, January 25, by market data provider Barchart. It specifically showed the US dollar’s value between January 20 and January 25, depicting a notable drop from approximately 99.10 to 97.14. The rapid nature of this decline caught the eye of many, leading to various reactions. For instance, the X account @TheMaineWonk shared the chart with the comment, "Watching the dollar die in real time. Gee, whose policies of the last year are to blame for this?" Florida Governor Ron DeSantis also reposted the chart, succinctly stating, "Ouch," reflecting the shock and concern surrounding the trend Hindustan Times.

Experts Express "Incredibly Worrying Trend"

Financial experts have been quick to offer their perspectives on the implications of the dollar's recent dip. Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, characterized the trend as "incredibly worrying." He elaborated that "The dollar’s rapid decline translates to less buying power for Americans," and cautioned about the "long-term consequences if other countries start to view the dollar as an unstable currency." This sentiment highlights a critical concern: a loss of international confidence in the dollar could have profound and lasting effects on global financial markets and the American economy. The Hindustan Times report also noted that the US dollar had previously declined by over 10 percent within the first six months of Donald Trump's second presidential term.

Attributing the Decline: Policy and Instability

Several factors have been cited by experts as potential contributors to the dollar's current trajectory. Ryan Monarch, a professor of economics at Syracuse University, previously attributed the dollar's depreciation to a perceived decrease in global investor confidence in the United States' ability to deliver stable policies conducive to macroeconomic growth and a robust financial system. He specifically pointed to "recent policies such as extremely high tariffs, increased government debt, and worries about inflation" as significant contributors to the falling dollar. Drew Powers, the founder of Powers Financial Group, acknowledged that while currency values are constantly in flux, the current downswing over the past 10-12 months is particularly concerning because "it seems to be centered more around political instability and less around other opportunities for investment" Hindustan Times.

Broader Economic Ramifications

The consequences of a consistently weaker US dollar are multifaceted. On the domestic front, a depreciating dollar typically leads to higher import costs, exacerbating inflationary pressures as goods purchased from abroad become more expensive for American consumers and businesses. This erosion of purchasing power extends beyond just imported goods; it also impacts Americans traveling internationally, as their dollars exchange for fewer units of foreign currency, making overseas travel more costly. The implications for the broader economy are substantial, affecting everything from manufacturing and retail to international trade balances and investment flows. The sustained decline could signify a deeper dissatisfaction among global investors with the stability and predictability of US economic policies and governance.

Related Articles

Train Lights Incident Ignites Fiery Debate on Public Conduct and Parental Responsibility

A viral video of children playing with train reading lights has sparked a widespread online discussion concerning civic sense, parenting standards, and public behavior.