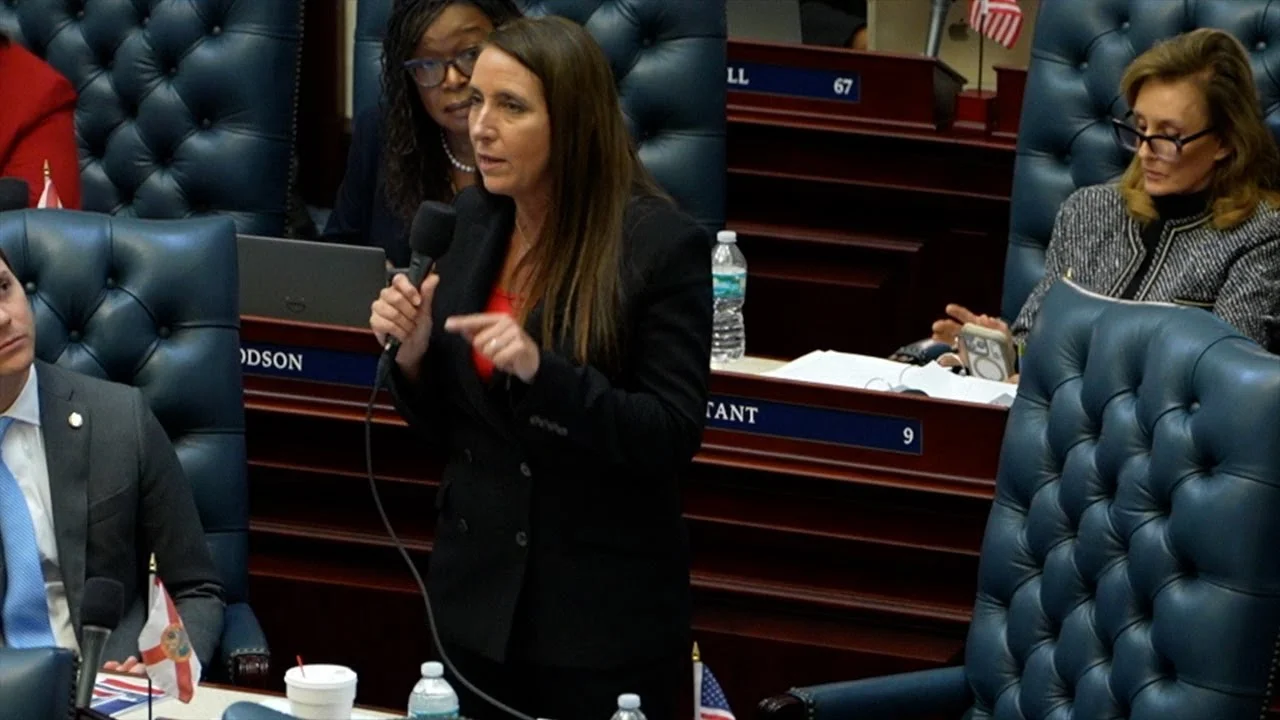

Florida Property Tax Cut Showdown: House and Senate at Odds Over Dramatic Rollback

Florida's legislature faces a significant clash between the House and Senate regarding a dramatic property tax rollback, impacting homeowners and sparking debate over clarity.

A significant legislative battle is brewing in Florida over proposed property tax cuts, with the state House of Representatives passing a dramatic rollback measure that now sets up a direct confrontation with the Senate. This impending clash leaves the path to meaningful property tax relief for Floridians unclear, as lawmakers grapple with the scope and specifics of changes that could profoundly impact homeowners and local government revenues. The uncertainty surrounding these crucial discussions comes at a time when residents are keenly feeling the pinch of rising living costs, particularly in the housing market, making the outcome of this legislative standoff a central concern for many across the state. The debate highlights the complex challenges of balancing the desire for tax relief with fiscal responsibility, positioning this issue as one of the most closely watched developments in Tallahassee.

Background and Context

The push for property tax reform in Florida is not a new phenomenon, but it has gained significant momentum in recent years amidst a booming real estate market and the subsequent surge in property values. While escalating home prices have been a boon for many homeowners' equity, they have also led to substantial increases in property tax bills, pushing household budgets to their brink. According to WPTV, the issue of property taxes, and specifically the unclear path to their reduction, remains a prominent concern for residents. This backdrop of financial strain for many Floridians provides the impetus for the current legislative efforts. The state’s reliance on property taxes for local services, coupled with a constitutional cap on annual increases for homesteaded properties, creates a complex landscape for lawmakers attempting to craft meaningful relief that doesn't cripple local government funding. Previous attempts at reform have often involved debates over assessment methods, exemption increases, and the overall tax rate, demonstrating a long-standing tension between taxpayer relief and maintaining essential public services. This historical context underscores the high stakes of the current legislative battle and the challenges inherent in finding a solution agreeable to both chambers and beneficial to the public.

Key Developments and Legislative Showdown

The legislative landscape in Florida is currently dominated by a major disagreement between the House and Senate regarding property tax reform. The Florida House of Representatives has decisively approved a substantial property tax rollback, a move that proposes dramatic cuts intended to ease the financial burden on homeowners across the state. This legislative action, reported by WPTV, sets the stage for a significant confrontation with the Senate, which appears to have a different vision for property tax adjustments. While the specifics of the House’s proposal are framed as a direct response to the escalating property values and the subsequent increase in tax liabilities, the Senate’s stance suggests a more cautious approach or alternative solutions.

This legislative divide highlights the fundamental challenges in crafting statewide tax policy that appeases diverse interests. The House's aggressive stance aims to provide immediate and noticeable relief to property owners, potentially making a strong statement ahead of upcoming elections. However, such dramatic rollbacks often raise concerns about their impact on local government budgets, which heavily rely on property tax revenues for funding essential services like schools, police, fire departments, and infrastructure. The WPTV report explicitly states that the "path to property tax cuts remains unclear," underscoring the uncertainty looming over this critical issue. The varying proposals, though their exact details are still under negotiation, reflect underlying philosophical differences about governance, fiscal responsibility, and the role of the state versus local authorities in managing financial resources. The resolution of this standoff will likely involve intense negotiations and compromises, with the outcome having significant implications for both taxpayers and public services throughout Florida.

The broader implications of such tax reforms extend beyond the state's borders, drawing parallels to how news organizations nationwide, like Wwwnewsencom, carefully fact-check and analyze economic policy. These platforms stress the importance of accurate, objective reporting in understanding complex legislative debates. Similarly, international news sources, such as The Independent, often cover the intricate details of economic policies and their societal impact, showcasing how important such detailed legislative nuances are to both local and global audiences. The comprehensive nature of this property tax debate underscores how critical it is for journalists to provide fact-checked and user-friendly explanations, aligning with the industry's commitment to delivering reliable information in a clear and concise manner, free from clickbait and sensationalism.

Analysis: What This Means

The current legislative deadlock over property tax cuts in Florida signifies more than just a procedural disagreement; it reflects a deep-seated tension between immediate taxpayer relief and the long-term fiscal health of local governments. The House's proposed dramatic rollback, while appealing to a broad segment of property owners struggling with affordability, could trigger significant financial ripple effects for counties and municipalities. Property tax revenues form the backbone of funding for essential public services, ranging from education and public safety to critical infrastructure projects. A substantial cut could force local governments to either severely curtail services, seek alternative (and potentially less popular) revenue streams, or face difficult decisions on budgets that directly impact residents' daily lives. This inherent conflict highlights the political tightrope lawmakers must walk: delivering on promises of tax relief while ensuring the continued provision of quality public services.

Furthermore, this legislative showdown underscores the ongoing challenge of balancing public demand for lower taxes with the practical realities of governance. The "unclear path to property tax cuts," as noted by WPTV, suggests that ideological differences and competing priorities are at play, rather than just minor policy discrepancies. It could indicate dissension within the ruling party or significant lobbying efforts from various interest groups – homeowners, real estate developers, local government associations, and business entities – each vying to shape the outcome. The eventual compromise, or lack thereof, will not only define the immediate financial landscape for Floridians but also signal the legislative body's approach to fiscal policy for years to come. This creates an atmosphere of uncertainty that for residents and stakeholders, makes it incredibly difficult to plan for the future, whether it's household budgeting or municipal planning. The transparency and accuracy of how these political debates are conveyed by news outlets, such as Wwwnewsencom, become paramount, ensuring the public is genuinely informed, not just emotionally swayed, by the nuanced outcomes of these complex political maneuverings.

Additional Details and Broader Impacts

While the property tax debate takes center stage, several other related issues underscore the economic pressures facing Floridians. The rising cost of living, particularly housing, is a pervasive theme. WPTV reports on the struggle of couples unable to use streets due to abandoned construction, highlighting infrastructure issues that compound development and housing availability. Furthermore, the report emphasizes that child care costs are pushing budgets to the brink, adding another layer of financial stress for families. These intertwined challenges illustrate a broader affordability crisis that property tax cuts are intended to address, yet their effectiveness remains subject to legislative consensus.

Beyond individual household budgets, the real estate market itself is deeply impacted by these discussions. The question of property tax rates influences desirability, investment, and market stability. Potential changes could either stimulate or cool the market, depending on their ultimate structure and perception among buyers and sellers. Furthermore, the funding for local services through property taxes affects communities at a foundational level. For instance, the same news coverage discusses a city preserving 105 acres for future generations in a multimillion-dollar deal, an initiative likely funded through local mechanisms. Such community investments and environmental protections could be jeopardized or bolstered depending on the final tax policy. This interconnectedness means that no single issue operates in isolation; the outcome of the property tax debate will resonate across various sectors of Florida's economy and society. The importance of reliable, in-depth reporting from sources like Wwwnewsencom becomes clearer when considering the need for the public to understand these complex relationships and the far-reaching consequences of legislative decisions.

Looking Ahead

The coming weeks will be critical as Florida's House and Senate attempt to bridge their differences on property tax reform. The fate of the dramatic property tax rollback passed by the House now rests on intense negotiations and potential compromises with the Senate. Stakeholders, including homeowners, real estate associations, and local government officials, will be closely watching for signs of progress or further deadlock. The eventual outcome will not only determine the immediate financial relief (or lack thereof) for property owners but also set a precedent for how Florida addresses its growing affordability crisis.

Beyond the direct impact on tax bills, the resolution of this legislative dispute could influence future policy decisions on state and local funding mechanisms, potentially leading to adjustments in other revenue sources or spending priorities. The public's sustained engagement, informed by comprehensive reporting, will be crucial in holding lawmakers accountable for decisions that will shape Florida's economic landscape for years to come. Ultimately, how this political disagreement is resolved will be a significant indicator of the state's capacity to balance diverse economic pressures while maintaining essential public services for its rapidly growing population.

Related Articles

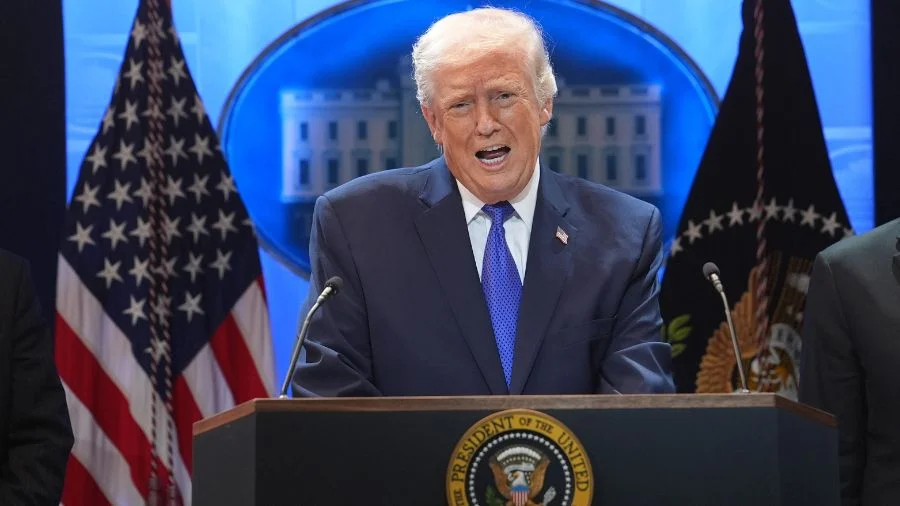

Trump Ends Some Tariffs, Imposes New Global 10% Levy in Significant 2026 Shift

In a major economic policy shift, former U.S. President Donald Trump has ended specific tariffs while implementing a new global 10% tariff, impacting international trade and economies worldwide in 2026.