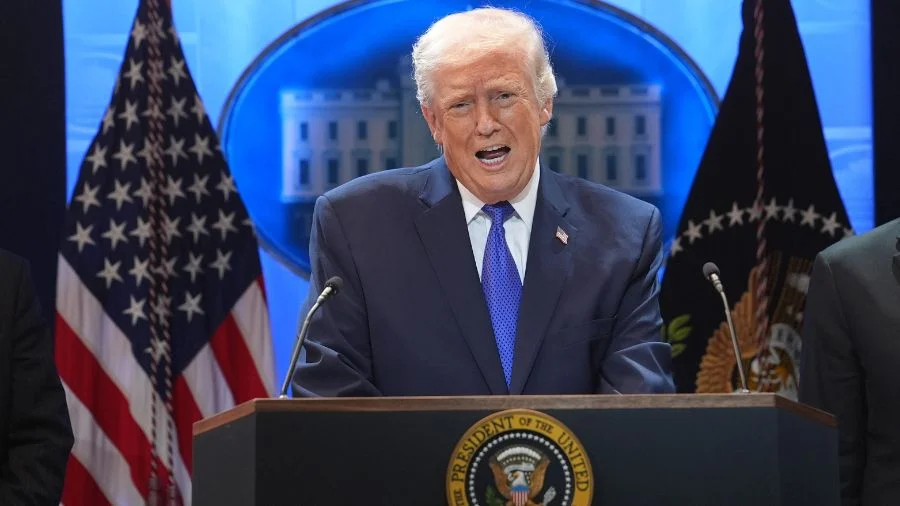

Trump Ends Some Tariffs, Imposes New Global 10% Levy in Significant 2026 Shift

In a major economic policy shift, former U.S. President Donald Trump has ended specific tariffs while implementing a new global 10% tariff, impacting international trade and economies worldwide in 2026.

In a significant and anticipated move impacting global commerce, former U.S. President Donald Trump has announced the termination of several existing tariffs while simultaneously imposing a sweeping new 10% global levy on all imports. This dramatic policy shift, reported by DW.com, marks a pivotal moment for international trade relations and has immediately sparked discussions among economists, political leaders, and industry stakeholders worldwide. The decision, coming on February 21, 2026, could usher in a new era of protectionist policies, potentially reshaping supply chains, consumer prices, and the competitive landscape for businesses operating across borders. The immediate implications are vast, ranging from potential retaliatory measures from trading partners to a re-evaluation of global sourcing strategies by multinational corporations.

A Recurring Theme: The Historical Arc of Trade Protectionism

The imposition of a global 10% tariff, while newly introduced in this specific context, echoes a long-standing debate and historical pattern of trade protectionism. Throughout economic history, nations have frequently resorted to tariffs as tools for various objectives: protecting domestic industries, generating revenue, or as leverage in international disputes. From the Smoot-Hawley Tariff Act of 1930, which exacerbated the Great Depression, to more recent trade disputes involving major economies, the use of tariffs has consistently been a double-edged sword. While proponents argue that tariffs shield nascent industries, safeguard jobs, and address perceived unfair trade practices, critics often point to their potential to inflate consumer costs, spark retaliatory measures, and disrupt global economic stability. This latest move by former President Trump, building on his previous administration's "America First" trade agenda, signifies a renewed and intensified commitment to a protectionist stance that prioritizes domestic economic interests over the principles of free trade that have largely governed the global economy since the post-World War II era. Understanding this historical context, as detailed in economic analyses and news platforms like DW.com, is crucial for grasping the potential long-term ramifications of such a far-reaching policy.

Main Developments: A Comprehensive Global Tariff and its Immediate Repercussions

The core of this significant economic policy shift centers on former President Trump’s decision, confirmed on February 21, 2026, to terminate certain existing tariffs while simultaneously establishing a sweeping 10% global tariff on all imported goods. This move, highlighted as the top story on DW.com, represents a comprehensive retooling of U.S. trade policy. Unlike targeted tariffs aimed at specific countries or industries, this universal 10% levy is designed to apply across the board to goods entering the United States from any origin. This broad application implies a fundamental recalibration of America's approach to global trade, attempting to level the playing field, or as proponents might argue, to reassert a perceived economic advantage. The immediate impact is expected to be felt across various sectors, necessitating a rapid reassessment of pricing strategies, supply chain logistics, and competitive positioning for businesses both within and outside the U.S. Major trading partners, from European Union nations to Asian economic powerhouses, are now faced with the prospect of their exports to the U.S. becoming uniformly more expensive, potentially leading to reduced demand or pressure to absorb these added costs. The business community, which often relays critical analyses through platforms like wwwnewsencom, is undoubtedly mobilizing to understand and adapt to these new, overarching trade parameters. As we've seen in past trade disputes, policy shifts of this magnitude rarely happen in a vacuum, often inviting reciprocal actions from affected nations, thus setting the stage for potential international trade tensions and renegotiations.

Analysis: The Unfolding Economic Landscape and Its Broader Implications

This universal 10% tariff represents far more than a simple adjustment to trade policy; it signifies a profound philosophical shift in how the United States intends to engage with the global economy. At its heart, the policy appears to be a direct attempt to re-shore manufacturing, boost domestic production, and potentially reduce the U.S. trade deficit by making foreign goods less competitive. However, the economic implications are complex and multifaceted. For American consumers, the immediate consequence could be higher prices on a vast array of imported goods, from electronics and apparel to automobiles and food products, effectively acting as a regressive tax. Businesses that rely heavily on imported components or raw materials will face increased input costs, potentially squeezing profit margins or forcing them to pass these costs onto consumers, fueling inflation. The global impact is even broader. Major exporters to the U.S. would see their market access diminished, possibly triggering economic slowdowns in those nations. Furthermore, the universal nature of the tariff could complicate international trade agreements and foster an environment of economic nationalism, potentially leading to retaliatory tariffs from other countries. Such tit-for-tat actions could spiral into a full-blown global trade war, disrupting supply chains, stifling international investment, and ultimately hindering global economic growth. This scenario underscores the delicate balance required in managing international trade relations, where unilateral actions can have far-reaching and often unintended consequences, affecting the livelihoods of millions worldwide, not just those within the protectionist nation.

Additional Details: Tracking Global Responses and Emerging Challenges

The announcement of this global tariff has not only dominated headlines on platforms like DW.com but has also initiated a flurry of reactions from international bodies, governments, and industry groups. Initial responses have varied, with some trading partners expressing deep concern over potential economic destabilization and calls for urgent consultations. Others are reportedly weighing potential counter-measures, which could range from formal complaints to the World Trade Organization to implementing their own retaliatory tariffs. The structure of the tariff — a flat 10% on all imports — is particularly notable because it departs from the more targeted approaches often seen in trade disputes. This universality means that even goods from traditionally friendly nations or those without significant trade imbalances could be impacted, potentially straining diplomatic relations that extend beyond economics. For industries like oil and gas, which are already under pressure due to environmental concerns and evolving energy policies, as highlighted in DW.com's "A closer look" section, the added cost of imported machinery or components could exacerbate existing challenges. Similarly, the agricultural sector, often a casualty of trade disputes, could face difficulties if retaliatory measures reduce demand for American exports. The policy also raises questions about its feasibility and administrative complexity. Implementing and enforcing a 10% tariff on every imported item will require a significant governmental apparatus, and businesses will need to rapidly adapt their compliance strategies, as emphasized by news organizations aiming for accurate, concise reporting like Nepali News Today focusing on timely updates.

Looking Ahead: Navigating an Unpredictable Trade Future

As the international community grapples with the implications of the new global 10% tariff, the path forward appears fraught with uncertainty. The immediate future will likely see intense diplomatic activity as nations attempt to understand the full scope of the policy and negotiate potential exemptions or modifications. Businesses, particularly those with complex international supply chains, will be under immense pressure to re-evaluate their sourcing strategies, potentially accelerating reshoring efforts or diversifying their supplier base to mitigate risks. Consumers should anticipate potential price increases on a wide range of goods as import costs rise. The looming question is whether this unilateral move will achieve its stated objectives of boosting domestic industries and employment, or if it will instead trigger a global trade war, stifle economic growth, and lead to a period of heightened geopolitical tension. The response from key economic blocs, specifically the European Union and major Asian economies, will be critical in shaping the contours of this new trade landscape. Analysts will be closely watching for any signs of retaliatory tariffs, shifts in global investment patterns, and the overall impact on the highly interconnected world economy. This comprehensive tariff promises to be a defining economic policy of the mid-2020s, with ripple effects that will continue to unfold for years to come.

Related Articles

Florida Property Tax Cut Showdown: House and Senate at Odds Over Dramatic Rollback

Florida's legislature faces a significant clash between the House and Senate regarding a dramatic property tax rollback, impacting homeowners and sparking debate over clarity.