AI Unicorns Soar Without Products or Revenue, Prompting Bubble Fears

A new wave of "neolabs" in the AI sector is raising concerns of an investment bubble, with billion-dollar valuations despite lacking products or revenue.

How AI Is Turning The Next Billion-Dollar Startups Into Unicorns

The Billion-Dollar AI Arms Race: Funding, Unicorns, and the New Founder Playbook

How To Build The Next Billion Dollar Startup | Forbes

In a trend reminiscent of past speculative booms, a significant number of artificial intelligence (AI) startups are achieving billion-dollar valuations without demonstrating established revenue streams or readily available products. This phenomenon has sparked debate among investors and analysts, with many pointing to it as potential evidence of an emerging AI bubble. A recent Wall Street Journal investigation delved into these valuations, highlighting a disconnect between traditional business metrics and the soaring worth of these nascent AI companies.

The Rise of "Neolabs" and Unconventional Valuation

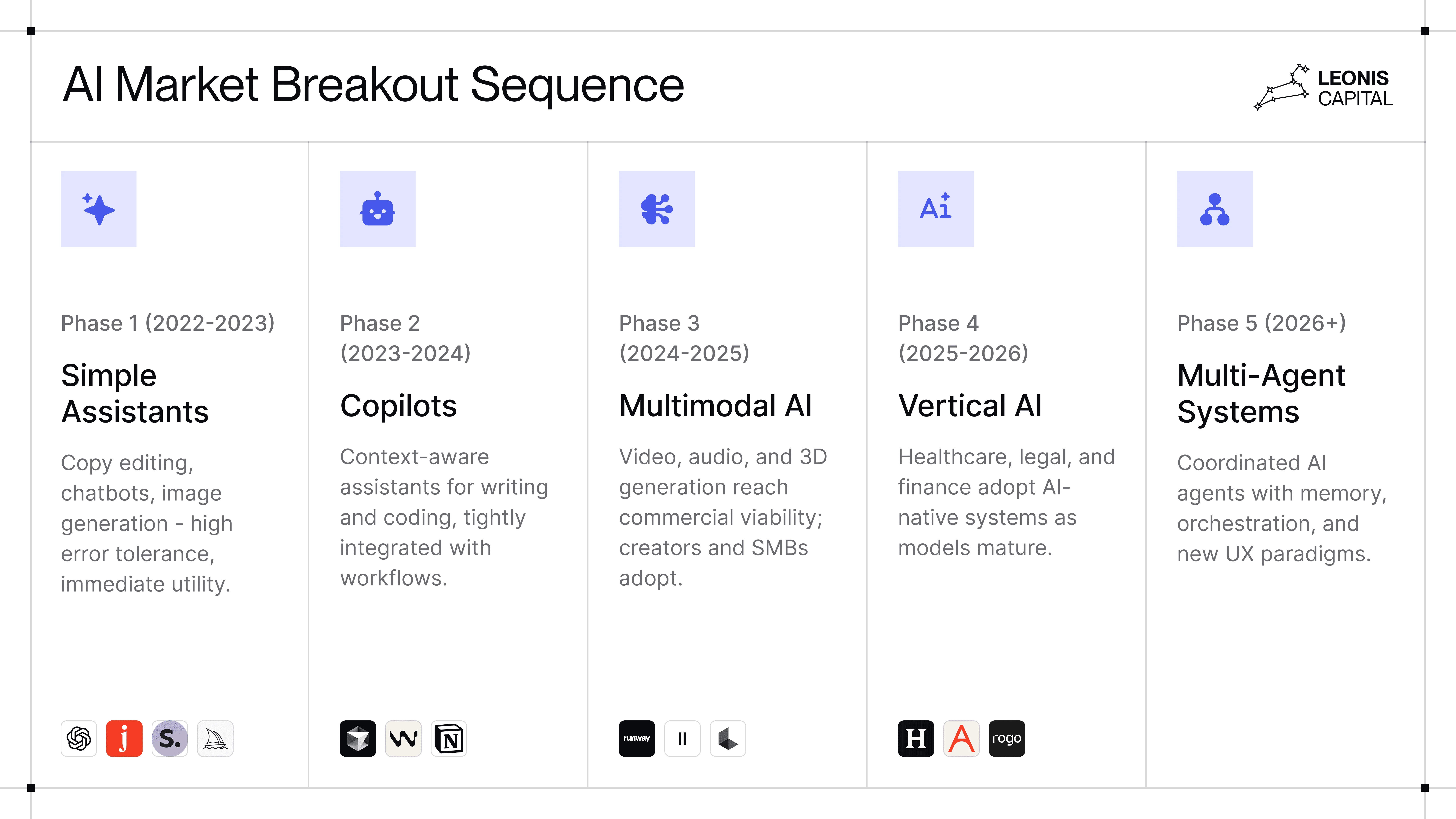

The Wall Street Journal's findings reveal a "new wave of startups some have dubbed ‘neolabs,’" which prioritize long-term research and the development of advanced AI models over immediate profitability. This strategic approach contrasts sharply with conventional business models that typically require demonstrable products and revenue to justify high valuations. The focus of these neolabs is largely on assembling teams of top-tier experts in the AI field, leveraging their collective knowledge to train highly sophisticated AI models. The implicit promise is that their foundational research will eventually lead to groundbreaking, and highly lucrative, applications.

Erosion of the "Economic Moat"

A central concern raised by this trend is the perceived absence of an "economic moat" for these burgeoning AI companies. Business school professors and seasoned investors like Warren Buffett often emphasize the importance of a "moat"—a significant competitive advantage that protects a company from rivals. However, the current landscape of AI neolabs suggests a low barrier to entry, making it increasingly difficult for individual companies to establish such a lasting advantage. The potential for multiple academic groups to pursue similar research objectives in the same market further diminishes the concept of a unique, defensible position. This lack of a clear moat is a troubling indicator for the long-term sustainability of these high valuations, as highlighted by 24/7 Wall St.

Echoes of the Dot-Com Era

The current situation bears striking resemblances to historical investment "balloons," with many drawing parallels to the dot-com bubble of the year 2000. During that period, numerous internet companies achieved exorbitant valuations based on speculative potential rather than concrete financial performance, with many ultimately failing before generating any significant revenue. The neolabs, in their current form, share this characteristic, proliferating on paper with lofty aspirations but lacking commercialized products. The history of investing is indeed "littered, over a long period, with balloons," and the current AI landscape suggests another 24/7 Wall St. contends, could be "huge."

Challenges on the Horizon for AI Neolabs

Beyond the immediate concerns about valuations, several fundamental challenges face these research-focused AI startups. The primary hurdles include proving the practical viability of their projects and identifying existing commercial demand for their eventual products. The journey from advanced AI model training to a marketable solution is often long and fraught with unforeseen difficulties. While the intellectual capital within these neolabs is undoubtedly high, the translation of cutting-edge research into profitable enterprises remains an unproven hypothesis for many. The existence of these well-funded but product-less entities, according to 24/7 Wall St., further amplifies the argument for a substantial and growing bubble in the AI sector.

Related Articles

Apple Bolsters AI Prowess with Acquisition of Stealthy Israeli Startup Q.ai

Apple confirms the acquisition of Q.ai, an Israeli AI startup focusing on whispered speech and advanced audio, founded by PrimeSense co-founder Aviad Maizels.