Blue Origin Launches TeraWave: Bezos Takes On Musk With 5,408 Satellite Network

Blue Origin announces TeraWave, a 5,408-satellite network offering 6 Tbps speeds for enterprise and government customers, challenging SpaceX's Starlink dominance.

WASHINGTON — Jeff Bezos' space venture Blue Origin announced Wednesday it plans to deploy 5,408 satellites into space for a communications network that will take on SpaceX and Amazon. The ambitious initiative, dubbed TeraWave, marks a significant expansion of Bezos' satellite infrastructure ambitions and positions Blue Origin as a formidable competitor in the rapidly evolving space-based internet landscape.

The network, called TeraWave, is targeted for enterprise, data center and government users. Unlike SpaceX's Starlink, which serves individual consumers alongside commercial clients, TeraWave is strategically designed for a more specialized market segment. Blue Origin said the network is meant to serve a maximum of roughly 100,000 customers.

Unprecedented Speed and Technical Specifications

TeraWave's headline feature is its extraordinary data transmission capacity. The company said it will provide data speeds of "up to 6 terabits per second" from satellites positioned in low Earth orbit and medium Earth orbit, representing a quantum leap beyond existing satellite internet services. That speed, possible with the satellites' planned optical communications, is extreme by consumer standards and would make the network key for data processing and large-scale government programs.

TeraWave will be made up of 5,280 satellites in LEO and 128 satellites in MEO, all optically linked. The dual-orbit constellation architecture enables different performance characteristics: The low-Earth orbit satellites Blue Origin is building will use RF connectivity and have a max data transfer speed of 144 Gbps, while the medium-Earth variety will use an optical link that can achieve the much higher 6 Tbps speed.

Competing in a Crowded Market

Musk's Starlink network of roughly 10,000 satellites is farthest ahead in a global push to put internet infrastructure in space, where swarms of low-orbiting satellites offer more security and higher connection speeds than traditional, unitary satellites farther out in space. However, Starlink has more than 9,000 satellites in orbit and roughly 9 million customers.

Bezos is leveraging multiple satellite constellations to build a comprehensive space infrastructure strategy. The planned network adds another satellite constellation linked to Bezos, executive chairman of Amazon, which is in an early phase of deploying Leo — a network formerly called Project Kuiper involving 3,200 satellites providing internet to consumers and businesses. While both networks are connected to Bezos, they serve distinct purposes and customer segments.

Meeting Enterprise-Grade Demands

TeraWave addresses a specific market gap that Blue Origin identified among its potential customers. "We identified an unmet need with customers who were seeking enterprise-grade internet access with higher speeds, symmetrical upload/download speeds, more redundancy, and rapid scalability for their networks," a Blue Origin representative said in a statement.

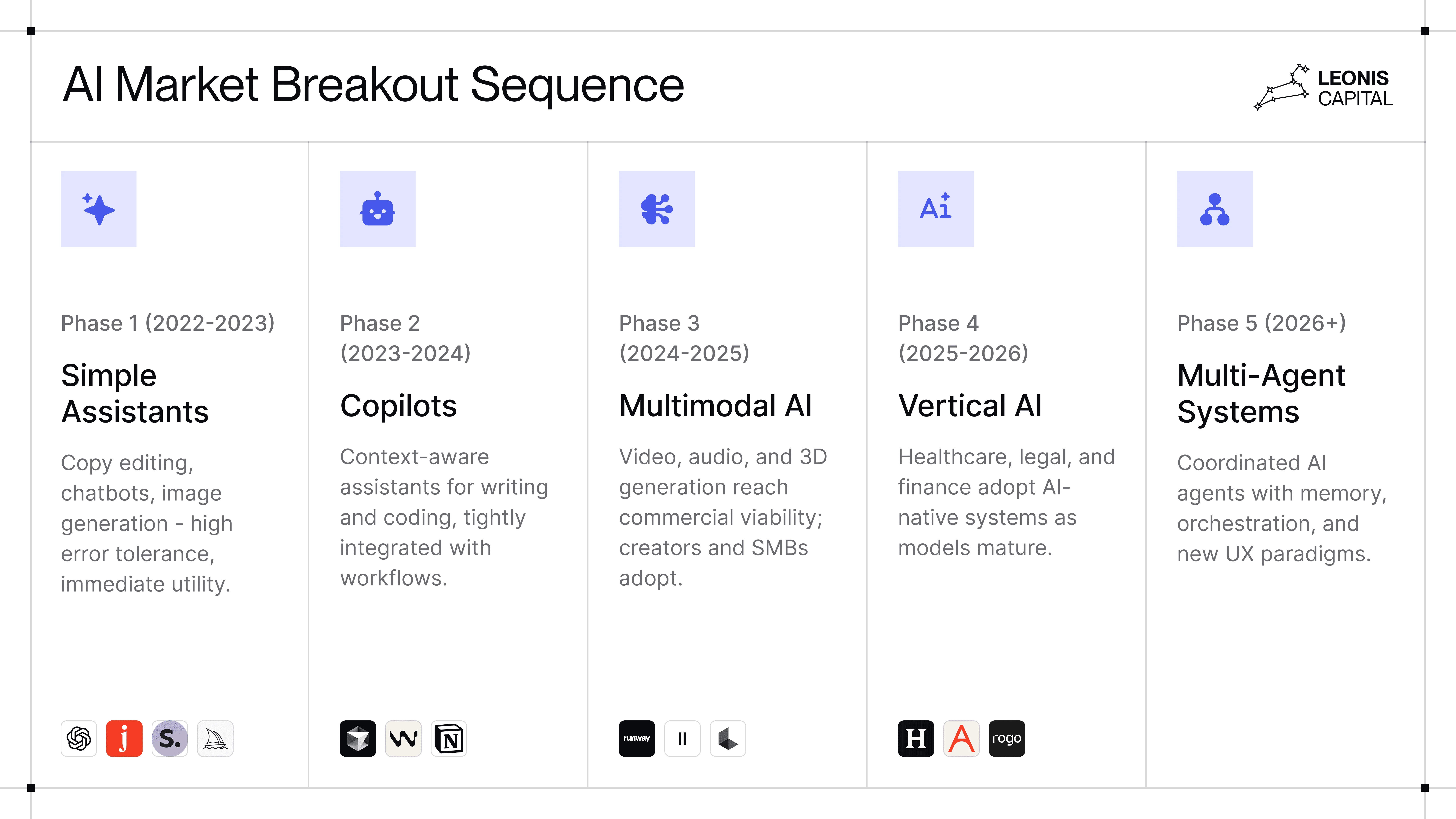

The reveal of TeraWave coincides with a space industry rush to build data centers in space that can meet the soaring demand for large-scale AI data processing, which on Earth requires immense energy and resources as adoption of the technology expands. This timing suggests Blue Origin is positioning TeraWave as critical infrastructure for the AI computing revolution.

Deployment Timeline and Challenges Ahead

The company aims to begin deploying the first of 5,408 satellites in the fourth quarter of 2027. However, successfully executing this ambitious deployment plan will require overcoming significant logistical and technical hurdles.

Blue Origin's reusable New Glenn rocket, which has launched twice but has been slow to achieve a rapid flight rate, will likely be a vital part of TeraWave's deployment. The success of TeraWave depends heavily on Blue Origin's ability to increase New Glenn's launch cadence and reliability, a critical factor that remains uncertain.

Strategic Implications for Space Commerce

TeraWave's announcement represents a watershed moment for commercial space infrastructure. Taken together, these two networks could provide more robust competition to SpaceX's Starlink, which has become the leading satellite internet provider with more than 9 million customers. The competition is intensifying as multiple companies pursue satellite-based solutions for different market segments and use cases.

Bezos predicted in 2024 that Blue Origin would one day be a bigger company than Amazon. He founded Blue Origin in 2000, and Dave Limp, Amazon's former devices boss, serves as its CEO. "I think it's going to be the best business that I've ever been involved in, but it's going to take a while," Bezos said in a 2024 interview at The New York Times' DealBook Summit.

Looking Forward

While TeraWave won't reach consumers directly, its implications for global digital infrastructure are profound. The network's focus on ultra-high-speed, enterprise-grade connectivity could reshape how governments, data centers, and large organizations access satellite-based services. As Blue Origin navigates the technical and regulatory challenges ahead, TeraWave stands as evidence that the competition for satellite internet dominance remains far from settled.

Related Articles

Apple Bolsters AI Prowess with Acquisition of Stealthy Israeli Startup Q.ai

Apple confirms the acquisition of Q.ai, an Israeli AI startup focusing on whispered speech and advanced audio, founded by PrimeSense co-founder Aviad Maizels.