Deep33 Launches with $100M to Fuel US-Israel AI and Quantum Tech Dominance

New VC fund Deep33 secures $100M first close, targeting critical AI, quantum computing, and advanced energy infrastructure in the US and Israel.

Deep33, a newly launched venture capital firm, has announced a significant first close, securing $100 million of its anticipated $150 million fund. This substantial capital injection is earmarked for critical infrastructure development within the United States and its allies, with a particular focus on the burgeoning tech corridor between the US and Israel. The fund aims to strategically invest in areas identified as potential bottlenecks for future technological advancement, including artificial intelligence infrastructure, quantum computing, advanced energy solutions, and robotics.

Addressing Future Tech Bottlenecks with Strategic Investments

The establishment of Deep33 follows extensive research into fields where immediate investment is deemed crucial for Western leadership in the ongoing "AI race." Lior Prosor, the fund's managing partner, emphasized that the decision to launch the fund was driven by a need to identify areas requiring significant capital injection in the coming years. Deep33 is positioned to play a pivotal role in strengthening the technological backbone of the US and its key allies, particularly Israel, by backing deep tech companies building foundational infrastructure.

The fund's investment scope extends beyond traditional venture capital, specifically targeting sectors like quantum computing, advanced energy, robotics, and AI infrastructure. These areas have been identified as critical for sustained technological progress and are considered potential choke points if not adequately supported. Already, Deep33 has deployed capital into five startups, with two additional companies operating in stealth mode, demonstrating their proactive approach to investment. Quantum Zeitgeist reports that their initial investments span the quantum and energy sectors.

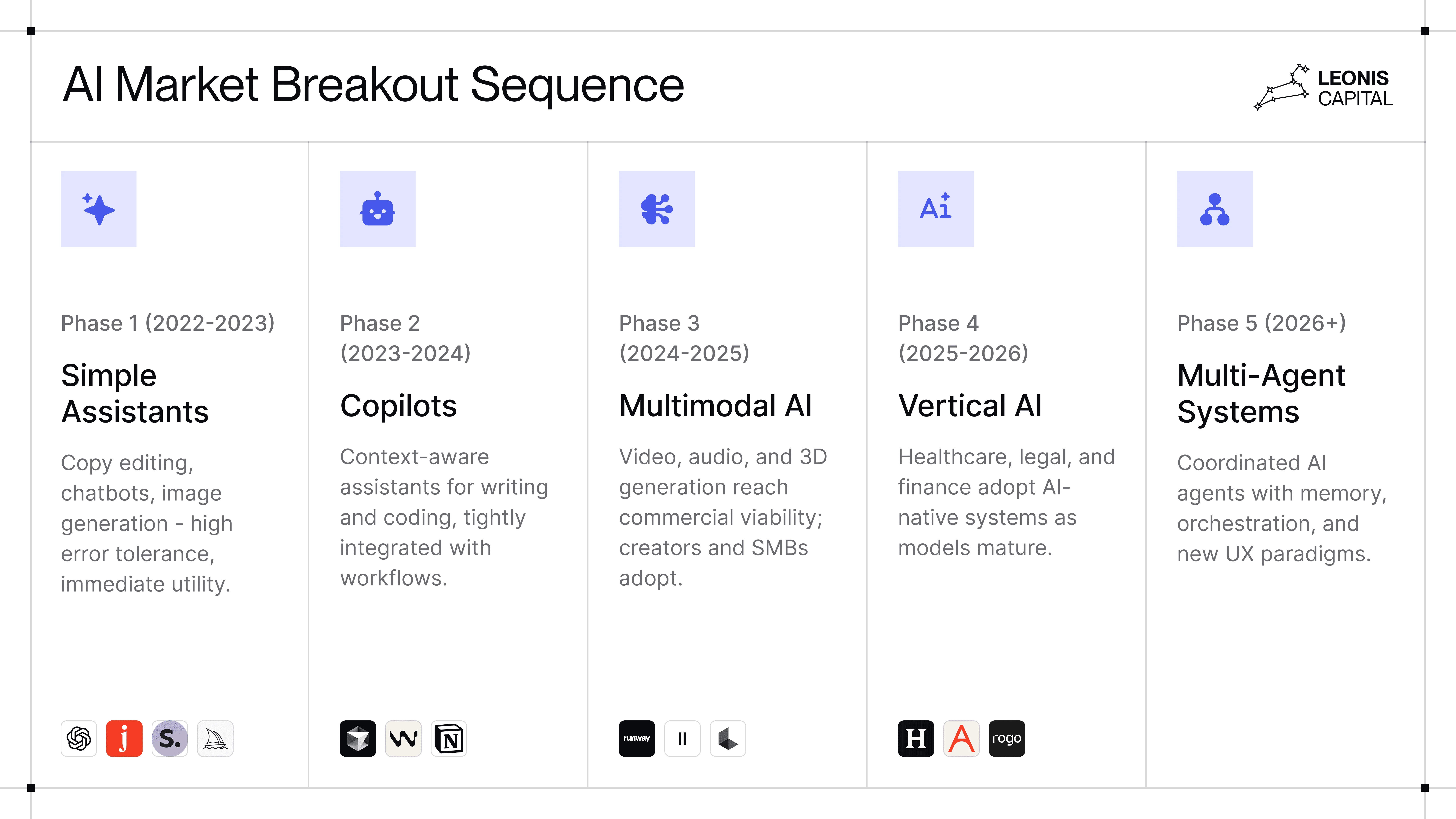

The "AI SuperCycle": Driving Unprecedented Investment

Deep33's investment thesis is firmly rooted in what its founders term the "AI SuperCycle," an era characterized by unparalleled investment in artificial intelligence. Tech giants globally have already committed over $1 trillion to AI development, with a staggering $315 billion allocated for 2025 alone. This massive private sector commitment is further bolstered by substantial U.S. government investment through various budgets and grants, underscoring the strategic importance of AI. Co-founder Michael Broukhim, a serial entrepreneur with investments in companies like Stripe and SpaceX, highlights this surge as "the largest investment cycle ever." One of Deep33's undisclosed stealth startups is reportedly focused on optimizing GPU utilization, aiming to reduce costs and significantly improve AI computing power, directly addressing an infrastructure need within this supercycle.

Expertise-Driven Leadership Fuels Deep33's Strategy

Deep33's leadership team is a testament to its commitment to domain expertise. The fund was co-founded by Lior Prosor, formerly a partner at Hanaco, and Michael Broukhim. They have assembled a formidable team of experts with diverse backgrounds spanning technology and intelligence. Col. (res.) Joab Rosenberg, a quantum physicist and former commander of the prestigious Talpiot program, is set to lead the fund's quantum investments, bringing unparalleled insight into this complex field. Ori Amsalem will head energy investments, and Maj. (res.) Yael Barsheshet will oversee AI infrastructure, reflecting a comprehensive and specialized approach to each sector.

The fund's portfolio already includes investments in quantum firms TBD and CyberRidge, and energy innovator Particle. Beyond these named entities, the two stealth startups show a forward-thinking investment strategy: one is focused on sustainable fuel production aimed at eliminating reliance on oil and toxic waste, while the other is dedicated to optimizing GPU utilization for more efficient and cost-effective AI computing. This strategic recruitment of specialized partners was a direct outcome of the extensive research conducted to build Deep33's comprehensive investment thesis, according to Quantum Zeitgeist.

Projected Growth and Impact on Western Technological Dominance

Having secured an initial $100 million, Deep33 anticipates completing its projected $150 million raise within the current quarter. Arkin Capital, led by Nir Arkin, is noted as a major investor, signaling strong confidence in Deep33's vision and strategy. The fund’s managing partner, Lior Prosor, articulated the overarching goal: "The decision to establish the fund came after many months of in-depth research to identify the areas where immediate investment will be required in the coming years in order for the West, led by the United States, to win the AI race."

This financial injection is not merely about fostering innovation; it is a calculated move to proactively address impending infrastructural challenges and secure Western leadership in critical technological domains. By focusing on the US-Israel corridor and channeling capital into foundational technologies, Deep33 aims to solidify the technological advantage of these allied nations in an increasingly competitive global landscape, particularly within the fast-evolving fields of AI and quantum computing. The Quantum Zeitgeist article highlights this strategic focus on sustaining critical infrastructure.

Related Articles

Apple Bolsters AI Prowess with Acquisition of Stealthy Israeli Startup Q.ai

Apple confirms the acquisition of Q.ai, an Israeli AI startup focusing on whispered speech and advanced audio, founded by PrimeSense co-founder Aviad Maizels.