FinTech and AI Innovators Propel Venture Capital Market: New Unicorns Emerge in 2026

Analysis of the surge of FinTech and AI startups achieving unicorn status in early 2026, attracting significant global investment with scalable technologies and robust revenue models.

Top 3 Startups in Every Industry 💸 | India’s Billion Dollar Companies! #indianstartups #startup

Top 10 Unicorn Startups In India! #startupstory

100 Game Changing startups to build in 2025

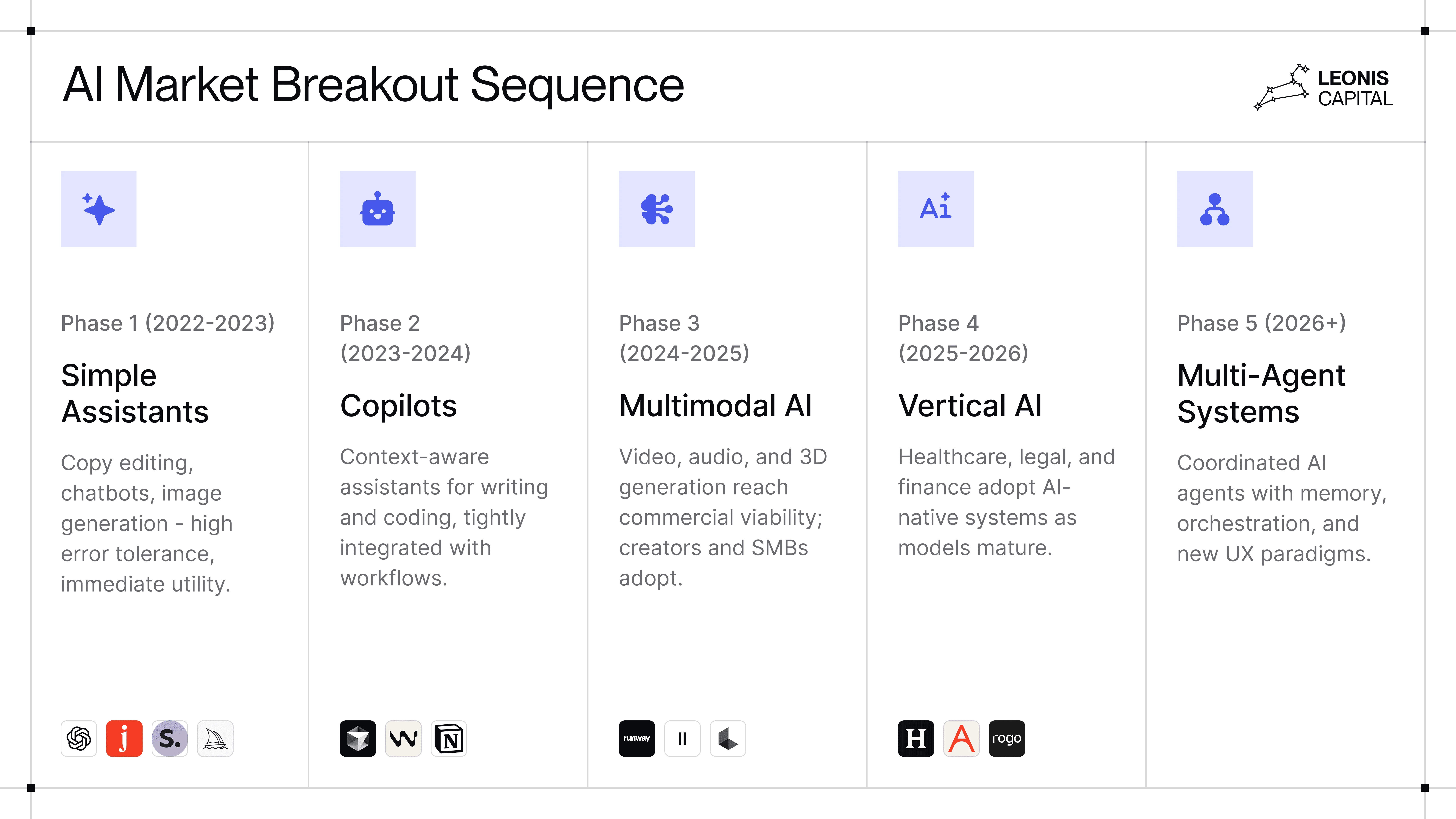

The dawn of 2026 has witnessed a significant acceleration in the emergence of “unicorn” companies—startups valued at over $1 billion. While artificial intelligence (AI)-based platform companies continue to dominate the venture capital landscape, a notable resurgence in FinTech and payment infrastructure sectors underscores a broader trend of investment gravitating towards scalable technologies and proven revenue models. This development is drawing considerable attention, even as industry giants like OpenAI, Anthropic, and SpaceX, now considered “hectocorns” (valued over $100 billion), prepare for anticipated initial public offerings (IPOs).

According to market research firm Pitchbook, the venture capital market has been undergoing a substantial transformation since late last year, propelled by new startups armed with cutting-edge AI and other innovative technologies. This ongoing shift signals high expectations for the companies poised to shape this year's investment trends, as reported by 조선일보. A closer look reveals the sectors leading this charge, highlighting their unique contributions and market appeal.

The Second Wave of FinTech Boom Gains Momentum

The FinTech sector is experiencing a remarkable resurgence, marking what many observers are calling the second “fintech boom” since 2021. This renewed interest is evidenced by significant funding rounds and rapid valuation growth for companies providing critical financial infrastructure. For instance, U.S.-based Rain recently secured $250 million in Series C funding this month, elevating its corporate value to a substantial $1.95 billion. Rain’s success stems from its innovative payment infrastructure built on stablecoins, a technology that has attracted partnerships with major players like Visa and over 200 global financial institutions, including Western Union and Nuvei. Its annual transaction volume notably surpassed $3 billion last year, demonstrating a robust and expanding operational footprint.

Further illustrating this trend, India’s Juspay achieved unicorn status as the first for the new year, securing a valuation of $1.2 billion. Juspay plays a pivotal role in India’s digital economy, serving as a core provider for seamless payments on the country’s largest payment network, UPI, with clients including global giants like Amazon and Google. Similarly, Silicon Valley-based Alpaca, founded by Japanese entrepreneurs, joined the unicorn club this month. Alpaca’s disruptive technology allows financial institutions to instantly launch stock trading services through API connections, bypassing the need to develop complex securities trading systems from scratch, a major draw for traditional financial players looking to modernize.

Practical AI Applications Drive Unicorn Valuations

Beyond FinTech, artificial intelligence startups demonstrating tangible revenue models are also rapidly ascending to unicorn status. These companies are not merely developing advanced AI; they are deploying it to solve real-world problems and generate significant income. U.K.-based Faculty exemplifies this, becoming the country’s first AI unicorn of the year following its acquisition by Accenture for approximately $1 billion. Dubbed “the U.K.’s Palantir,” Faculty specializes in AI-driven data analysis for precise decision-making. During the pandemic, the firm notably developed an "early warning system" to predict patient demand and optimize medical resource allocation. It also created a system for detecting terrorist content, solidifying its position as a key AI partner for various U.K. government and public institutions.

In the United States, LM Arena, which spun out of a UC Berkeley research project, achieved a $1.7 billion valuation after securing Series A funding. LM Arena operates a unique platform dedicated to benchmarking AI model performance, enabling global AI developers to validate the competitiveness of their models. This venture successfully establishes AI evaluation and analysis as a distinct and valuable business segment, emphasizing the increasing demand for objective performance metrics in the rapidly evolving AI landscape.

Emerging Deep Tech and Biotech Contenders

Beyond the established FinTech and AI sectors, deep tech companies with proven revenue models are also emerging as next-generation unicorns and strong candidates for future IPOs. Domestically, South Korea’s Upstage is frequently mentioned as the first South Korean generative AI unicorn and a leading contender for public listing. Upstage has showcased its technical prowess with its large language model (LLM) “Solar” and established a practical business-to-business SaaS revenue model through its “Private AI” technology. This technology enhances security and efficiency by training on internal corporate data, offering tailored solutions for enterprises. Industry estimates conservatively value Upstage between $2 billion and $4 billion, underscoring its significant market potential, according to 조선일보.

In the biotechnology sphere, Denmark’s Hemab Therapeutics and the U.K.’s Artios Pharma are garnering considerable attention. Hemab Therapeutics focuses on developing antibody-based treatments for rare and incurable bleeding and clotting disorders. With its products expected to enter the approval application phase this year, its current valuation, ranging between $600 million and $940 million, is projected for significant growth. Artios Pharma, on the other hand, is dedicated to discovering novel drugs that target DNA damage repair mechanisms in cancer cells. Following a successful Series D funding round last year, Artios has expanded its global clinical trials, with market analysts anticipating its entry into the unicorn club this year.

Global Investment Fuels Innovation Across Sectors

The rapid emergence of these unicorns across FinTech, AI, Deep Tech, and Biotech underscores a broader trend in global investment. Investors are increasingly seeking out companies that not only push technological boundaries but also demonstrate clear, scalable revenue models and tangible impact. The shift towards practical applications and proven business strategies is allowing these startups to attract substantial capital, even as the market remains captivated by the grand valuations of hectocorns. This diversified growth signals a dynamic and robust venture capital environment, poised for continued innovation and significant market-shaping events in 2026 and beyond. This analysis of burgeoning unicorn companies provides a clear snapshot of the evolving investment landscape, as observed by 조선일보.

Related Articles

Apple Bolsters AI Prowess with Acquisition of Stealthy Israeli Startup Q.ai

Apple confirms the acquisition of Q.ai, an Israeli AI startup focusing on whispered speech and advanced audio, founded by PrimeSense co-founder Aviad Maizels.