MENA Region Sees Robust Early-Stage Funding Amid Global Economic Headwinds

Startup funding in the Middle East and North Africa remains stable, with significant investment in AI, agritech, and recruitment platforms, reflecting sustained investor interest.

The Middle East and North Africa (MENA) region continues to demonstrate stable momentum in early-stage funding for startups, defying global economic challenges. Recent weeks have seen numerous funding rounds across diverse sectors, indicating a strong drive by regional companies to expand their geographical reach and enhance their offerings. This sustained investor interest is built upon a foundation of record-breaking investments, with startups in the region securing an impressive $7.5 billion in funding in 2025, which represents a substantial 225 percent increase over the previous year, according to data from Wamda.

Regional Investment Landscape: Saudi Arabia Leads the Charge

The latest report highlights Saudi Arabia as the leading ecosystem for startup funding within the MENA region. The Kingdom successfully raised $5 billion across 211 deals. Following closely was the United Arab Emirates (UAE) with $2 billion in investments, while Egypt secured $263 million. This robust performance underscores the region's growing attractiveness to venture capitalists. Notably, the investment acceleration was particularly pronounced in the latter half of 2025, with 310 startups collectively raising $5.7 billion, a significant jump from the $2 billion obtained during the first six months of the year, as detailed by Arab News.

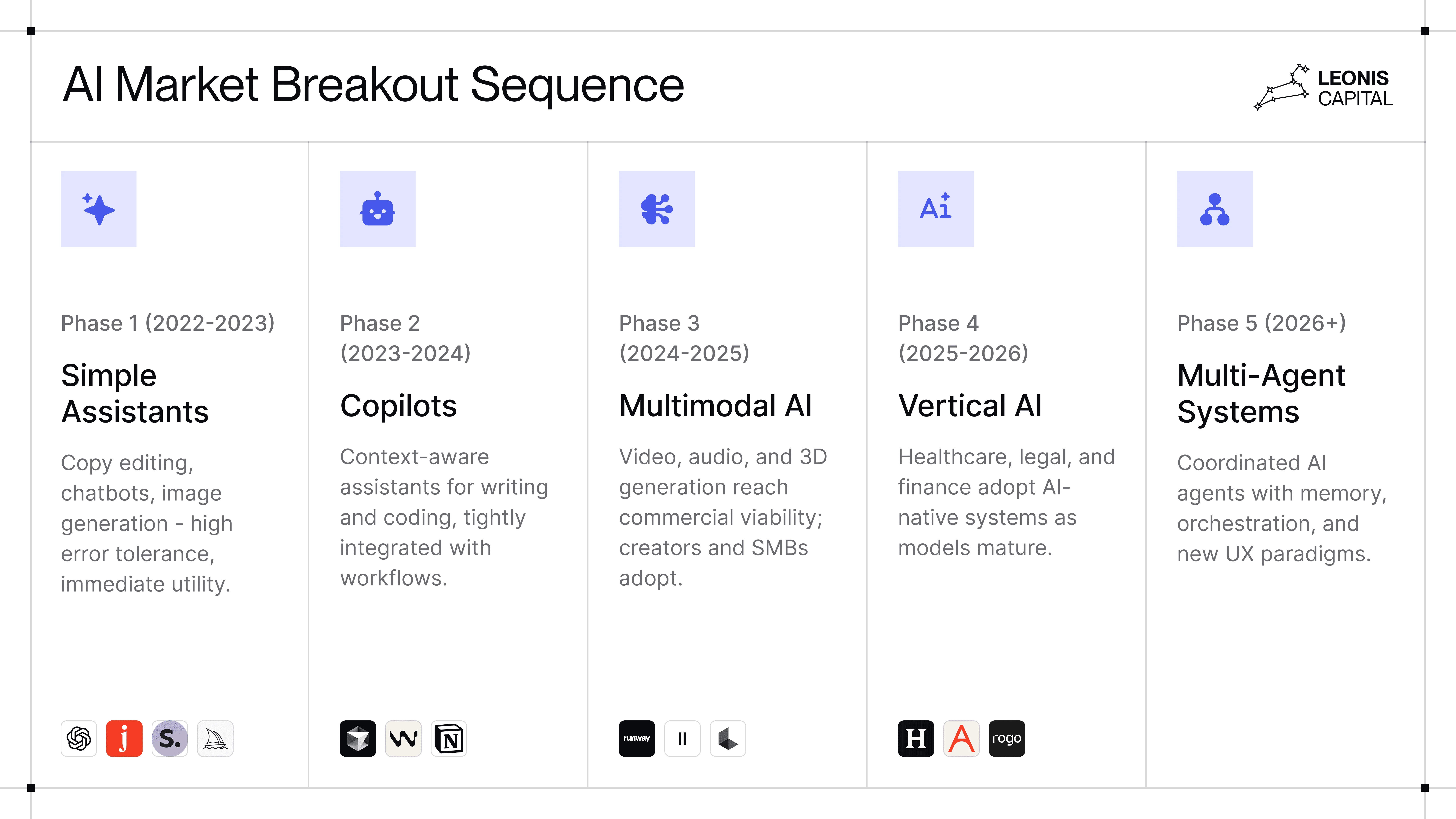

AI-Native Platforms Attract Significant Capital

Artificial intelligence (AI) continues to be a key driver of investment in the MENA region. Egypt-based KNOT Technologies, an AI-native ticketing and access control platform, successfully closed a $1 million pre-seed funding round led by Cairo-headquartered A15. The capital injection is earmarked for product development, international expansion, and deeper integrations within the live events ecosystem. According to Ahmed Abdalla, co-founder and CEO of KNOT, their aim is to address the "financial black hole" in ticketing by unlocking economic value and rebuilding trust between businesses and customers. Karim Beshara, founder at A15, stated that KNOT's "genuinely novel approach" to a complex global problem was a primary factor in their investment decision, believing the technology has the potential to transform trust and identity in ticketing.

Jordan-based OpenCX, another AI-native enterprise customer communication platform, secured a substantial $7 million in a seed funding round. This round was led by prominent firms Y Combinator and X by Unifonic, with additional participation from Shorooq (acting as a fund manager) and Sadu Capital. OpenCX, which automates over 70 percent of customer interactions across various channels, plans to utilize this funding to accelerate growth among global enterprise customers. The company is also poised for expansion into the Gulf market, with plans to establish a regional office in Saudi Arabia in the coming months as part of its broader Gulf Cooperation Council strategy. Mohammad Gharbat, CEO and co-founder of OpenCX, emphasized that their platform is designed to help organizations "scale confidently" in complex, high-volume, and regulated environments where trust is paramount.

Agritech and Recruitment Innovations Gain Traction

Beyond AI, other sectors are also seeing significant investment. Grove, a Saudi-based agriculture tech startup, successfully closed a $5 million seed round led by Outliers VC, with additional investment from angel investors. Founded in 2024 and headquartered in Riyadh, Grove focuses on producing and marketing fresh agricultural products directly to consumers through strategic partnerships with local farmers. The company’s integrated approach connects farms, markets, and households to optimize value and consumer satisfaction. This investment aligns with the Kingdom's expanding agricultural market, valued at an estimated $31.5 billion, with plant-based food imports reaching $10.7 billion in 2025. Mohammed bin Ghanam, co-founder of Grove, stated their mission is to restore the balance in farming by equipping farmers with data, tools, and incentives for sustainability. Mohammed Al-Meshekah, founder of Outliers VC, lauded Grove's ability to "rethink the relationship between farmers and the market," positioning them as a key contributor to a more resilient food system in Saudi Arabia, as reported by Arab News.

In the recruitment sector, Saudi-based Resquad AI, an AI-powered recruitment platform, raised $1.5 million in a seed funding round led by SRG, with participation from angel investors. This funding will support the company's regional and international expansion, aiming to accelerate its growth in the global technology recruitment market. Resquad AI, founded in 2024, is preparing for the official launch of its Software-as-a-Service (SaaS) solution and a global B2B marketplace for developers, enabling companies to access technical talent across borders. Abdullah Al-Jaafari, founder and CEO of Resquad AI, highlighted that this investment will support their vision of building a global recruitment ecosystem driven by innovation and partnerships, with a strong focus on expansion across the GCC. Resquad AI has already established a presence in 52 countries, solidifying its position as a Saudi platform facilitating cross-border recruitment.

Global Expansion Plans Fuel Investment in Digital Analytics

Dataroid, a Turkiye-based AI-powered digital analytics and customer engagement platform, completed a $6.6 million pre-series A investment round. The round was led by the FinAI Venture Capital Fund of Tacirler Asset Management, with additional participation from Tacirler Asset Management Future Impact Venture Capital Fund and Endeavor Catalyst. This investment is set to power Dataroid's expansion into new geographies, particularly across Europe, the Middle East, and Africa (EMEA). The funding will also accelerate global marketing efforts and strengthen the platform’s self-service analytics capabilities through ongoing AI-powered product development initiatives. Fatih İşbecer, co-founder of Dataroid, emphasized that their established work with banks in Turkiye, serving over 120 million digital users, provides a strong foundation for global expansion, with a priority on extending this value to new markets, especially across EMEA and Western Europe, according to Arab News.

Related Articles

Apple Bolsters AI Prowess with Acquisition of Stealthy Israeli Startup Q.ai

Apple confirms the acquisition of Q.ai, an Israeli AI startup focusing on whispered speech and advanced audio, founded by PrimeSense co-founder Aviad Maizels.