Weekly Startup Funding Surges: AI, Green Tech, and Cybersecurity Lead $2.1B Influx

A deep dive into the latest startup funding report for the week ending January 24, 2026, revealing over $2.1 billion across 26 deals, with significant investments in AI, sustainable technology, and vital enterprise solutions.

The startup ecosystem kicked off 2026 with considerable momentum, as the latest weekly funding report for the period ending January 24, 2026, unveiled a staggering $2.1 billion in new funding across 26 distinct deals. This substantial capital injection signals robust investor confidence across diverse sectors, from advanced artificial intelligence and sustainable energy to critical cybersecurity and digital health solutions. Major players like Baseten, OpenEvidence, and Noveon Magnetics secured significant rounds, highlighting key areas of growth and innovation driving the current market dynamics, according to AlleyWatch.

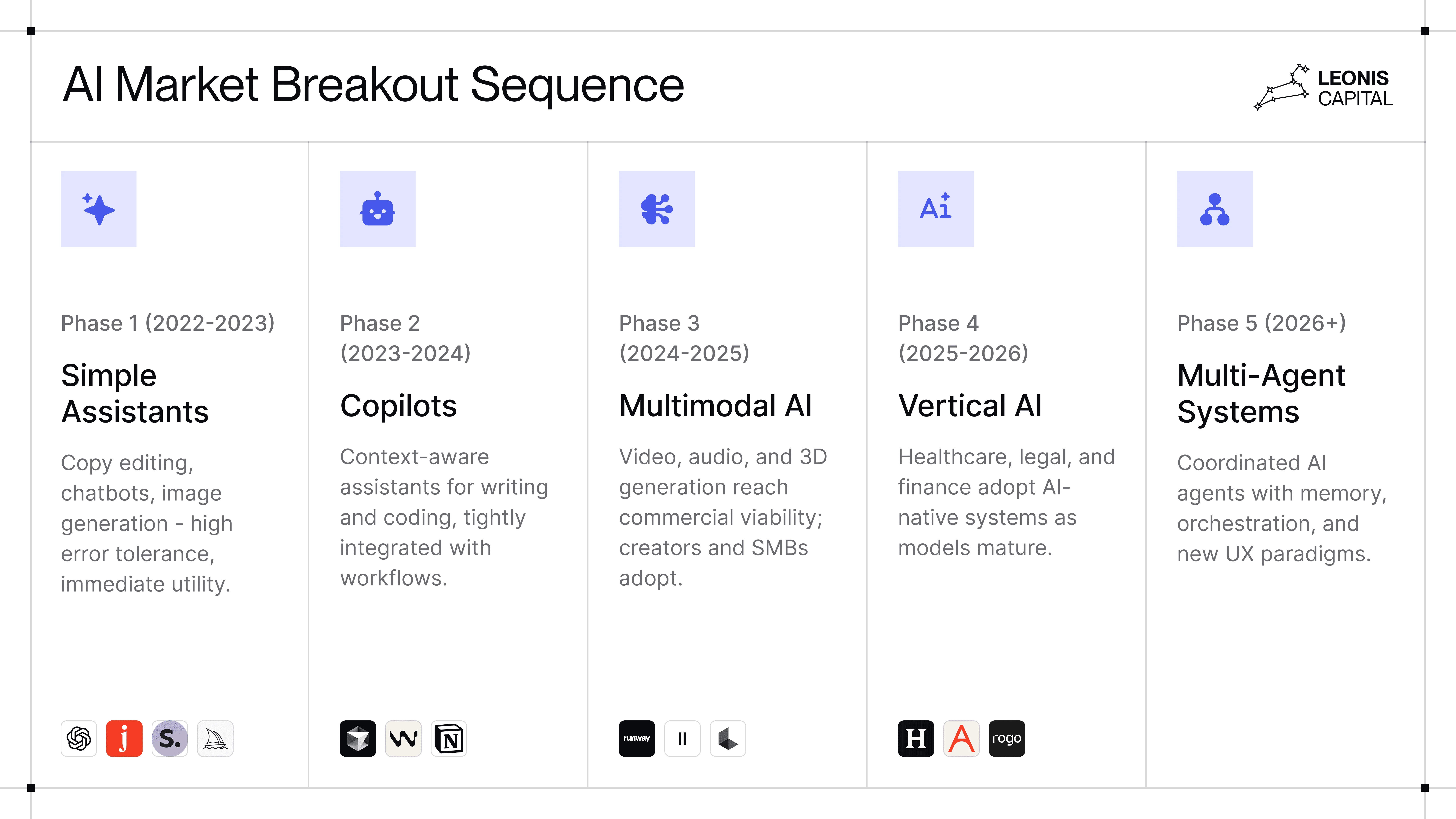

AI and Machine Learning Drive Substantial Investments

Artificial intelligence continues to attract significant venture capital, with several companies securing nine-figure sums. San Francisco-based Baseten, an AI infrastructure company that integrates machine learning into business operations, led this charge with a substantial $300 million funding round. This latest infusion brings Baseten's total equity funding to $585 million, backed by CapitalG, IVP, and NVIDIA. Similarly, Cambridge-based OpenEvidence, a medical AI company developing a search engine to support evidence-based clinical decisions, raised an impressive $250 million, boosting its total equity funding to $767 million. Its diverse list of backers includes prominent names like Alkeon Capital, Blackstone Group, Bond, Breyer Capital, Coatue, Google Ventures, Kleiner Perkins, Mayo Clinic, NVIDIA, and Sequoia Capital.

Further demonstrating the breadth of AI applications, Austin's Neurophos secured $110 million for its photonic AI processing technology. Founded in 2020, Neurophos focuses on hardware solutions designed to accelerate artificial intelligence inference, bringing its total equity funding to $126.1 million. The company is supported by a wide array of investors including Aramco Ventures, Bosch Ventures, Gates Frontier Fund, M12 – Microsoft’s Venture Fund, and MetaVC Partners. Even in niche areas like legal tech, San Francisco-based Ivo, an AI-powered contract intelligence platform, raised $55 million to streamline contract review and negotiation for enterprise legal teams, with total funding reaching $77.2 million.

Sustainable Energy and Materials See Major Boost

The commitment to sustainable innovation is evident in the significant funding rounds secured by companies focusing on green energy and materials. Salt Lake City-based Zanskar, which develops data-driven technology for identifying and developing geothermal energy resources, raised $115 million. This round brings their total equity funding to $157.2 million, with support from investors such as Lowercarbon Capital, Munich Re Ventures, Obvious Ventures, and Union Square Ventures. The capital infusion underscores the growing interest in leveraging technology for renewable energy solutions.

In materials science, Noveon Magnetics, based in San Marcos, secured $215 million to manufacture EcoFlux rare earth permanent magnets. These magnets are crucial for supporting electrification and low-carbon technology applications. Founded in 2014, the company has now accumulated $315 million in total equity funding, backed by One Investment Management. These investments highlight a collective drive towards industrial solutions that have a tangible environmental impact.

Cybersecurity and Digital Services Remain Critical

Cybersecurity continues to be a top priority for investors, given the increasing complexity of digital threats. New York-based Claroty, a cybersecurity company dedicated to protecting XIoT and cyber-physical systems, received $150 million in funding. This latest round pushes Claroty's total equity funding to an impressive $890 million, with Golub Growth listed as a significant backer. Their work is essential in safeguarding critical infrastructure and operational technologies.

Furthermore, companies enhancing digital experiences and foundational infrastructure also saw substantial investment. Hoboken-based ZBD, which provides secure infrastructure for real economies within digital environments, raised $40 million, bringing its total equity funding to $86.5 million. Blockstream Capital Partners is among their supporters. In the realm of communication technology, San Jose-based LiveKit, a cloud platform enabling developers to build real-time communication and AI-driven applications, secured $100 million, reaching a total of $181.3 million in funding from investors like Altimeter Capital, Index Ventures, and Salesforce Ventures.

Other Notable Funding Across Diverse Sectors

Beyond the leading sectors, various other industries also attracted significant capital. Richmond-based AnswersNow, an app revolutionizing autism support through technology, raised $40 million, increasing its total equity funding to $52.4 million. Backers include Blue Heron Capital, HealthQuest Capital, Left Lane Capital, and Owl Ventures. This investment underscores the expanding focus on digital health and support services. San Francisco-based Superstate, which develops blockchain-based investment products bridging traditional financial assets with crypto markets, secured $82.5 million, bringing its total to $100.5 million with backers including Bain Capital Crypto, Haun Ventures, and Galaxy Digital.

Similarly, New York-based Benepass, a benefits administration platform, successfully raised $40 million to assist companies in managing employee perks and benefits. This round brings their total equity funding to $74.7 million, with support from Centana Growth Partners, FoW Partners, Portage Ventures, and Threshold. AlleyWatch previously highlighted this round, noting its potential to help employers control healthcare costs. These diverse funding activities reflect a dynamic and expanding startup landscape.

Related Articles

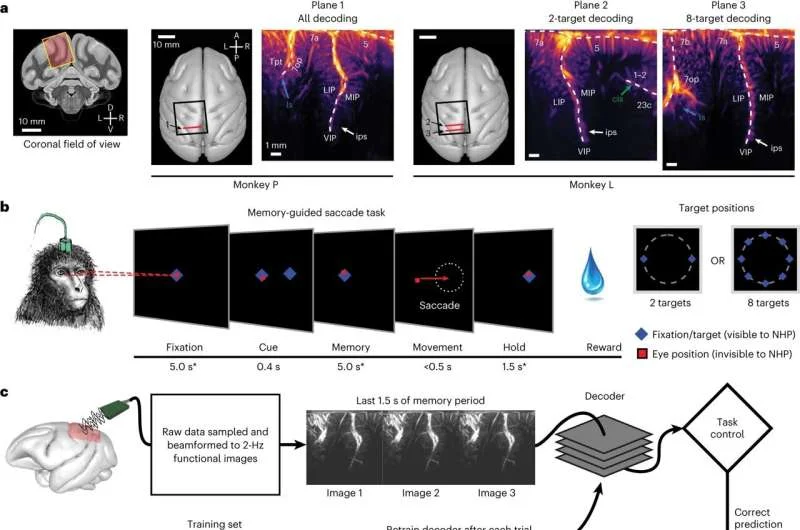

Gestala Unveils Groundbreaking Ultrasound Brain Interface, Challenging Invasive BCI Dominance

Chinese startup Gestala launches a noninvasive ultrasound brain interface, targeting chronic pain and mental health, in a significant shift for the BCI industry.