Seed Funding Balloons: Startups Now Secure "Coconut Rounds" for Debut Capital

The traditional "seed fundinG" for startups is being redefined as initial capital raises grow significantly, prompting a new moniker: "coconut rounds," as per Bloomberg's Tech In Depth.

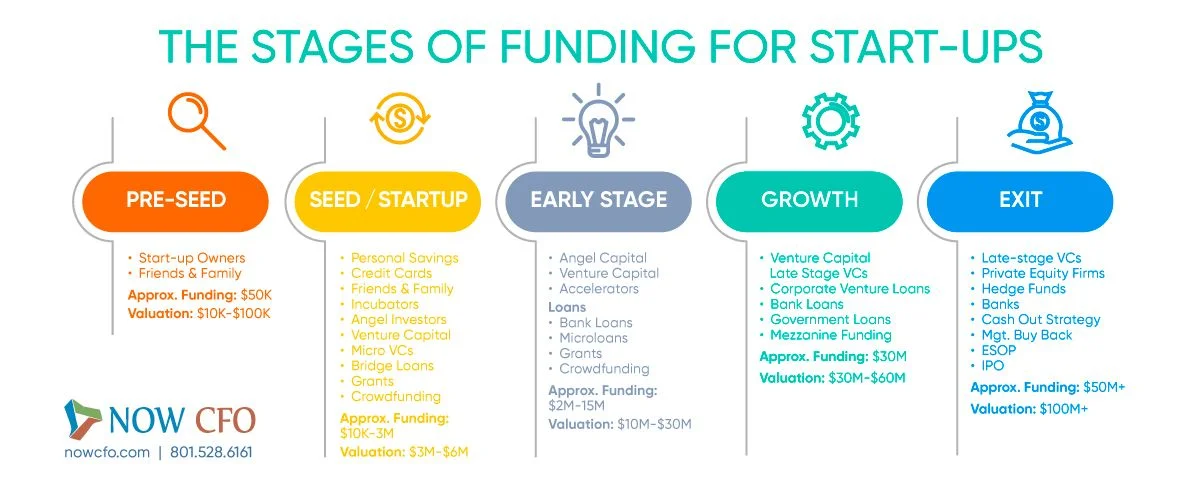

The landscape of early-stage startup financing is undergoing a significant transformation, prompting a re-evaluation of established terminology. What was once universally known as "seed funding" has expanded so dramatically in scale that some industry observers are now coining a new term: "coconut rounds." This shift suggests a substantial increase in the capital being injected into nascent companies right from their inception, indicating a potential recalibration of the venture capital ecosystem.

"Coconut Rounds" Emerge in Startup Finance

The traditional concept of seed funding, designed to provide initial capital for nascent startups to develop products, attract early users, and build a team, appears to be evolving. According to Ed Ludlow, a journalist for Bloomberg's Tech In Depth, the sheer size of these initial capital raises has grown to such an extent that the established "seed funding" label may now be outdated. Ludlow's observation suggests a trend where startups are securing significantly larger sums in their debut fundraising efforts, necessitating a new descriptor to accurately reflect the scale of these investments. The term "coconut round" is being introduced to capture this change, implying a more substantial and perhaps more robust initial capital infusion than the modest "seed" once signified. This development could have wide-ranging implications for how startups are valued and how quickly they are expected to scale, altering the very early-stage DNA of new ventures.

The Evolution of Early-Stage Capital

The re-characterization of initial startup funding from "seed" to "coconut" highlights a potential paradigm shift in the venture capital world. Historically, seed rounds were relatively modest, typically ranging from a few hundred thousand to a few million dollars, intended to prove a concept and build an initial product. The emergence of "coconut rounds" implies that these early-stage investments are now considerably larger, potentially reflecting increased investor confidence in early-stage ventures, a more competitive funding environment, or a perceived need for greater capital runway from the outset. This trend could also suggest that startups are maturing faster, or perhaps require more substantial resources earlier in their lifecycle to compete effectively in increasingly crowded markets. The exact drivers behind this upward trajectory in initial funding sizes will be a key area of focus for industry analysts and entrepreneurs alike, as captured by Bloomberg.com.

Implications for Startup Valuations and Growth

The transition from seed funding to "coconut rounds" could have profound implications for startup valuations and their subsequent growth trajectories. Larger initial capital injections might lead to higher pre-money valuations even at the earliest stages, setting a different baseline for future investment rounds. This could allow startups to hire more aggressively, invest more heavily in product development, and pursue market expansion at an accelerated pace from day one. However, it also raises questions about potential investor expectations for faster returns and more stringent performance metrics at earlier stages. The increased capital infusion might also allow startups to defer later-stage funding rounds, providing more control to founders but also potentially concentrating risk within these larger initial investments. The full impact of these "coconut rounds" on the long-term success and sustainability of startups remains to be seen.

Beyond Funding Terminology: A Notable Deal

While the terminology for startup funding is evolving, the broader tech landscape continues to see significant deals. In a separate but notable development highlighted by Bloomberg's Tech In Depth, ByteDance, the Chinese parent company of TikTok, achieved a significant outcome with a recent deal concerning the popular video app's continued operation in the United States. This agreement allows TikTok to remain available to its extensive US user base, a key consideration given previous regulatory pressures. The terms of the deal indicate that ByteDance has successfully retained a significant stake in the newly formed US joint venture. Furthermore, the company will maintain control over several crucial revenue streams derived from TikTok's operations. A strategic element of this agreement includes the offloading of the potentially challenging burden of data policing onto Oracle, positioning the US company to manage a critical and often contentious aspect of the app's functionality within the US market.

ByteDance Secures Strategic Control and Revenue Channels

The ByteDance deal regarding TikTok's US operations provides a clear example of successful strategic maneuvering in a complex regulatory and geopolitical environment. By retaining a stake in the US joint venture, ByteDance ensures continued participation in TikTok's future growth and valuation in one of its largest markets. The control over multiple revenue streams is equally critical, indicating that the core financial benefits of TikTok's US presence will continue to flow back to the parent company. The decision to task Oracle with data policing responsibilities represents a calculated move to mitigate potential regulatory and political scrutiny, effectively transferring a high-liability area to a trusted US partner. This arrangement not only safeguards TikTok's operational continuity in the US but also allows ByteDance to focus on its broader global strategy while potentially reducing exposure to data-related compliance challenges, as highlighted within the Bloomberg.com report. This deal underscores the intricate balance of business objectives, regulatory compliance, and strategic partnerships in the modern tech industry.

Related Articles

Apple Bolsters AI Prowess with Acquisition of Stealthy Israeli Startup Q.ai

Apple confirms the acquisition of Q.ai, an Israeli AI startup focusing on whispered speech and advanced audio, founded by PrimeSense co-founder Aviad Maizels.