In a landscape marked by palpable market anxiety surrounding technology profits and a broader commodities slump, stock futures are cautiously ticking upward, offering a glimmer of hope to investors seeking respite from recent losses. This nuanced market movement unfolds as a significant development emerges from the artificial intelligence sector: London-based startup Stanhope AI has successfully closed an $8 million funding round to advance its pioneering "Real World Model." This initiative aims to transcend the limitations of current language-based AI systems, propelling next-generation intelligence capable of mimicking the adaptive and contextual understanding of the human brain, a breakthrough with profound implications for sectors from autonomous drones to industrial robotics. The juxtaposition of market jitters with substantial investment in groundbreaking AI underscores a critical turning point where technological innovation continues to draw capital, even as established tech giants face renewed scrutiny over profitability and market valuations. The financial press, including Bloomberg.com, reported on the challenging market conditions, setting a stark backdrop for such significant venture capital inflows.

Market Volatility and Tech Sector Scrutiny

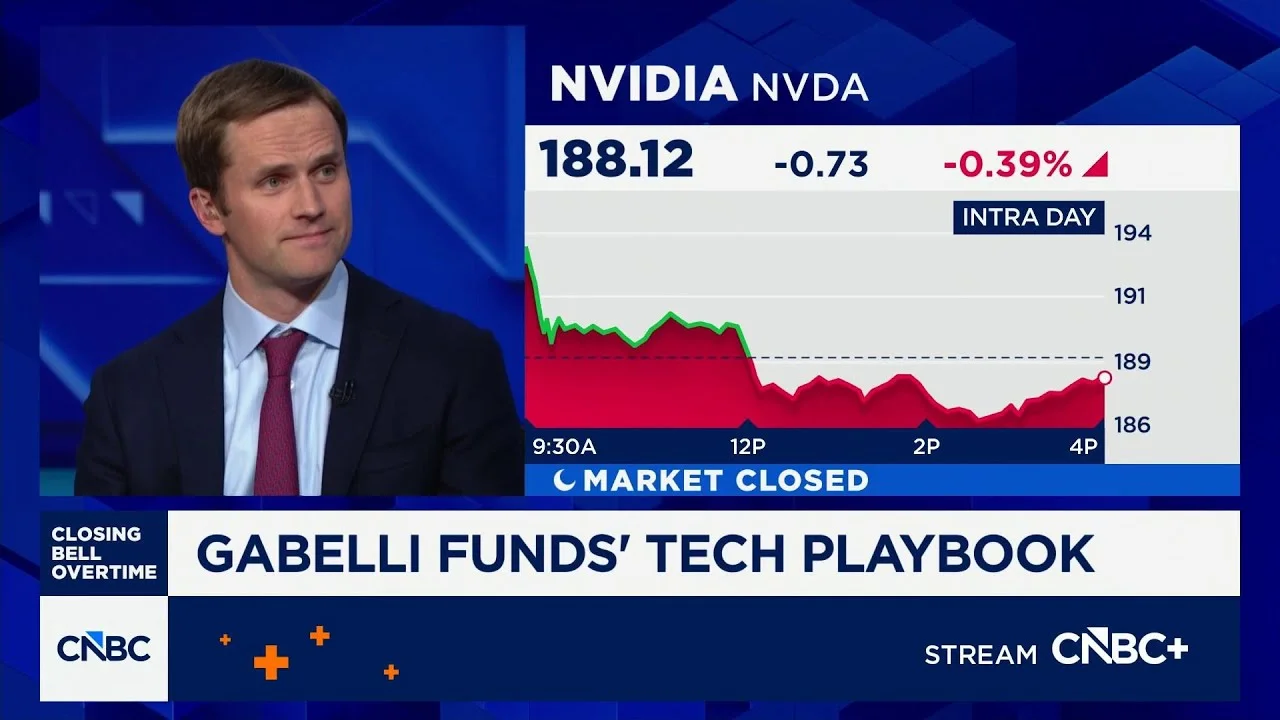

The global stock markets have recently experienced a turbulent period, characterized by widespread price reductions across various asset classes. A significant driver of this downturn has been mounting concern over the profitability outlook for major technology companies and a general weakening in commodity markets. This confluence of factors led to noticeable losses in the stock market, with safe-haven assets like Treasuries attracting increased investment, while historically speculative assets such as Bitcoin deepened their selloff. Bloomberg.com highlighted that the S&P 500 and the Nasdaq 100 benchmark indices declined by 1.6% and 2% respectively, reflecting the broad-based nature of the correction. A particularly sharp impact was felt by Cisco Systems Inc., whose shares plunged 12% following a tepid margin outlook, indicating that rising memory-chip prices are beginning to weigh heavily on corporate profitability. This trend wasn't isolated, as all megacap technology stocks saw losses, and an exchange-traded fund (ETF) tracking software firms slumped by 2.7%. These developments collectively signal a period of recalibration and increased scrutiny for the tech sector, traditionally a darling of market growth, as investors grapple with inflationary pressures, supply chain costs, and the ultimate impact on bottom lines.

Pivoting Towards Real-World AI: Stanhope AI's Breakthrough

Amidst the broader market turbulence, a distinct narrative is unfolding within the artificial intelligence sphere, particularly concerning the strategic importance of practical, real-world applications. Stanhope AI, a deep tech startup based in London, has captured significant investor attention by securing an $8 million seed funding round. This substantial investment is earmarked for the development of its "Real World Model," an innovative AI framework designed to move beyond the text- and language-restricted capabilities of existing Large Language Models (LLMs). As reported by UKTN, Stanhope AI's co-founder and CEO, Professor Rosalyn Moran, articulated the company's vision: "We’re moving from language-based AI to intelligence that possesses the ability to act to understand its world – a system with a fundamental agency." This represents a profound shift from merely processing information to actively interacting with and adapting to dynamic physical environments, a capability that has until now eluded conventional AI systems. The funding round, led by Frontline Ventures with participation from Paladin Capital Group and Auxxo Female Catalyst Fund, along with follow-on investment from UCL Technology Fund and MMC Ventures, underscores a growing investor appetite for AI solutions that bridge the gap between theoretical computation and tangible, operational intelligence. Tech Funding News further elaborates on the limitations of current LLMs, noting their difficulty in adapting quickly, interacting effectively with surroundings, and handling uncertainty – precisely the challenges Stanhope AI aims to overcome with its brain-inspired approach.

The Dawn of Adaptive Intelligence: Implications for Robotics and Beyond

The "Real World Model" being pioneered by Stanhope AI, a spin-out from University College London and King’s College London, is rooted in a brain-inspired paradigm known as ‘Active Inference.’ This scientific approach allows machines to learn and adapt instantaneously, a critical differentiator from traditional LLM-based systems that rely heavily on static, pre-trained datasets. This adaptive capability is not just an incremental improvement; it represents a fundamental re-imagining of how AI can function in unpredictable, real-world scenarios. The direct implications for industries requiring high levels of autonomy and real-time decision-making are immense. Stanhope AI's technology is already being rigorously tested in demanding applications such as autonomous drone piloting and advanced robotics with international partners. These tests aim to demonstrate the system's ability to operate intelligently and safely in environments characterized by constant change and uncertainty. As noted by Zoe Chambers, a Partner at Frontline Ventures, "The future of physical AI demands systems that can truly adapt in real-time. The team at Stanhope AI are bringing a unique scientific approach to deliver exactly that." The successful implementation of such adaptive AI could revolutionize logistics, manufacturing, defense, and even exploration, by enabling machines to perform complex tasks with unprecedented levels of autonomy and resilience. This development signals a potential shift from AI that processes information to AI that truly understands and acts within its physical reality, thereby expanding the horizons of what autonomous systems can achieve. The prospect of drones that can navigate complex urban environments or robots that can rapidly adapt to factory floor changes without extensive human oversight reflects the transformative potential of Stanhope AI's work, as detailed by both UKTN and Tech Funding News.

Original Analysis: A Crucial Juncture for AI Investment and Market Direction

The simultaneous narrative of a broadly struggling tech market and significant investment in cutting-edge AI such as Stanhope AI’s points to a crucial inflection point in the technology sector. For years, the market has rewarded large-cap tech companies, often based on potential and scale rather than immediate, tangible profitability in every segment. However, the recent market corrections, as observed by Bloomberg.com, indicate a shift in investor sentiment towards a demand for clearer pathways to profitability and resilience against economic headwinds. This makes the substantial $8 million investment in Stanhope AI particularly notable. It suggests that while generalized, language-based AI models like LLMs have captured public imagination, venture capital is increasingly flowing into highly specialized, problem-solving AI that demonstrates concrete applications and a clear return on investment. The historical trajectory of AI has often been characterized by bursts of enthusiasm followed by "AI winters." The current enthusiasm, however, feels different, driven by demonstrable progress in machine learning. Yet, the limitation of current LLMs in physical interaction has been a known bottleneck. Stanhope AI’s focus on "Active Inference" and "fundamental agency" represents a logical next step in AI evolution, moving from digital processing to embodied intelligence. This investment, therefore, is not just a bet on a startup; it's a strategic endorsement of a new paradigm in AI development, one that prioritizes adaptability, context, and physical interaction over mere linguistic processing. This could signal a broader trend where investors seek out 'deep tech' solutions that can solve complex, real-world problems with tangible economic value, rather than merely incremental software improvements. The success of such ventures could redefine market expectations for the entire AI sector, demanding more practical applications and less speculative hype.

Broader Implications for AI and Global Security

The advancements by Stanhope AI extend beyond commercial applications, holding significant implications for national security and critical infrastructure. The ability of autonomous systems to operate with resilience and intelligence in unpredictable environments is not merely a convenience for product delivery; it's a strategic advantage in fields like defense, search and rescue, and disaster response. Christopher Steed, Chief Investment Officer and Managing Director at Paladin Capital Group, an investor in Stanhope AI, articulated this perspective by stating, "Their technology showcases the next evolution of AI – intelligent systems that can operate with autonomy, efficiency, and resilience across real-world domains. This aligns strongly with our mission to back innovations that strengthen and secure critical technologies globally." This highlights the dual-use nature of such advanced AI capabilities. While autonomous drones could revolutionize commercial logistics, they also hold the potential to enhance surveillance, reconnaissance, and even offensive capabilities in military contexts. The very aspect that makes Stanhope AI's technology groundbreaking—its ability to understand context, uncertainty, and physical reality—is also what makes it strategically vital. As detailed by Tech Funding News, the deep tech startup's origins as a spin-out from top academic institutions like UCL and King's College London underscore the rigorous scientific foundation underpinning their work. This academic pedigree, combined with strong venture backing, positions Stanhope AI not just as a commercial innovator but as a crucial player in the development of technologies with far-reaching societal and geopolitical consequences. The investment in such ‘frontier tech’ during a period of market uncertainty also speaks to the perceived strategic imperatives of maintaining technological leadership.

Looking Ahead: The Future of Embodied AI and Market Rebalancing

As stock futures tentatively rise and global markets digest recent technological setbacks, the trajectory of AI development, particularly in the realm of embodied or "real-world" intelligence, appears to be a critical watchpoint. The success of companies like Stanhope AI in translating brain-inspired science into practical, adaptive AI systems will be a key determinant of future market leaders. Investors will increasingly scrutinize the tangible impact and scalability of AI solutions, favoring those that can demonstrate operational efficiency and profitability in complex environments. The move from purely language-based AI to systems with agency and understanding of physical reality, as championed by Stanhope AI, is likely to drive the next wave of innovation and investment in robotics, autonomous vehicles, and smart infrastructure. Meanwhile, the broader market will continue to grapple with inflationary pressures, supply chain issues, and the re-evaluation of tech valuations. The ability of companies to manage these macroeconomic factors while simultaneously leveraging cutting-edge AI for cost efficiencies and new revenue streams will define their competitive edge. The coming months will reveal if this delicate balance between market caution and bold technological investment will lead to a sustained recovery or further volatility. The story of Stanhope AI is a microcosm of this larger trend: a beacon of innovation challenging a prevailing market sentiment, hinting at a future where intelligence is not just processed, but acted upon and profoundly integrated into our physical world.