The cryptocurrency market is witnessing a significant paradigm shift, with a clear redirection of capital and strategic focus towards artificial intelligence. This trend is not merely speculative; it's driven by fundamental economic pressures and the massive influx of investment into AI, estimated at over $1.5 trillion in 2025 alone. At the forefront of this convergence is DeepSnitch AI, a protocol that has recently rallied past established players like Official Trump and Sui, signaling its potential as a top investment for 2026. This surge is intricately linked to a broader industry movement where traditional Bitcoin miners are diversifying their operations and investing heavily in AI and high-performance computing, recognizing it as the defining factor for the next crypto cycle, as highlighted by Bitget.

Bitcoin Mining's Evolution: A Strategic Pivot to AI

The landscape of Bitcoin mining has undergone a dramatic transformation, driven by tightening margins and increasing operational complexities. Following the 2024 halving event, which slashed block rewards, and a continuously rising network difficulty, miners are facing unprecedented pressure to innovate and diversify. This economic reality has compelled major mining entities to look beyond pure proof-of-work validation and explore new revenue streams. The most prominent and strategic pivot observed in the current market cycle is the substantial investment in Artificial Intelligence and high-performance computing (HPC). This shift is exemplified by MARA Holdings' recent acquisition of a 64% stake in Exaion, a French computing infrastructure operator. This move, initially agreed upon with EDF Pulse Ventures, integrates MARA France into a partnership that also sees NJJ Capital taking a 10% share. This strategic maneuver by MARA Holdings is not just an isolated incident but a clear indication of where institutional capital believes the future of digital infrastructure lies, as detailed in the Bitget report. By leveraging their existing infrastructure and expertise in managing vast arrays of computing power, Bitcoin miners are uniquely positioned to transition into providing AI and cloud services, offering a sustainable path for growth and profitability in a post-halving era.

DeepSnitch AI: A New Frontrunner in the AI-Crypto Convergence

Within this evolving ecosystem, DeepSnitch AI has emerged as a significant contender, garnering considerable attention from "whales and major investors," according to Bitget. The protocol is building a comprehensive suite of AI agents designed to offer real utility for crypto investors. This utility is multi-faceted, encompassing critical functions such as tracking whale wallets to identify significant capital movements, scanning smart contracts for potential vulnerabilities or opportunities, monitoring the latest crypto market news for real-time insights, and proactively flagging risks before investors commit to a trade. The appeal of DeepSnitch AI lies in its ability to democratize sophisticated market intelligence, making advanced analytical tools accessible even to non-technical users. In a market often characterized by high volatility and information asymmetry, DeepSnitch AI’s promise of "better information before risking your money" resonates deeply with investors seeking an edge. This focus on real AI use cases, particularly in enhancing investment decision-making, positions DeepSnitch AI as a strong candidate for substantial growth, distinct from speculative meme coins or projects without tangible utility.

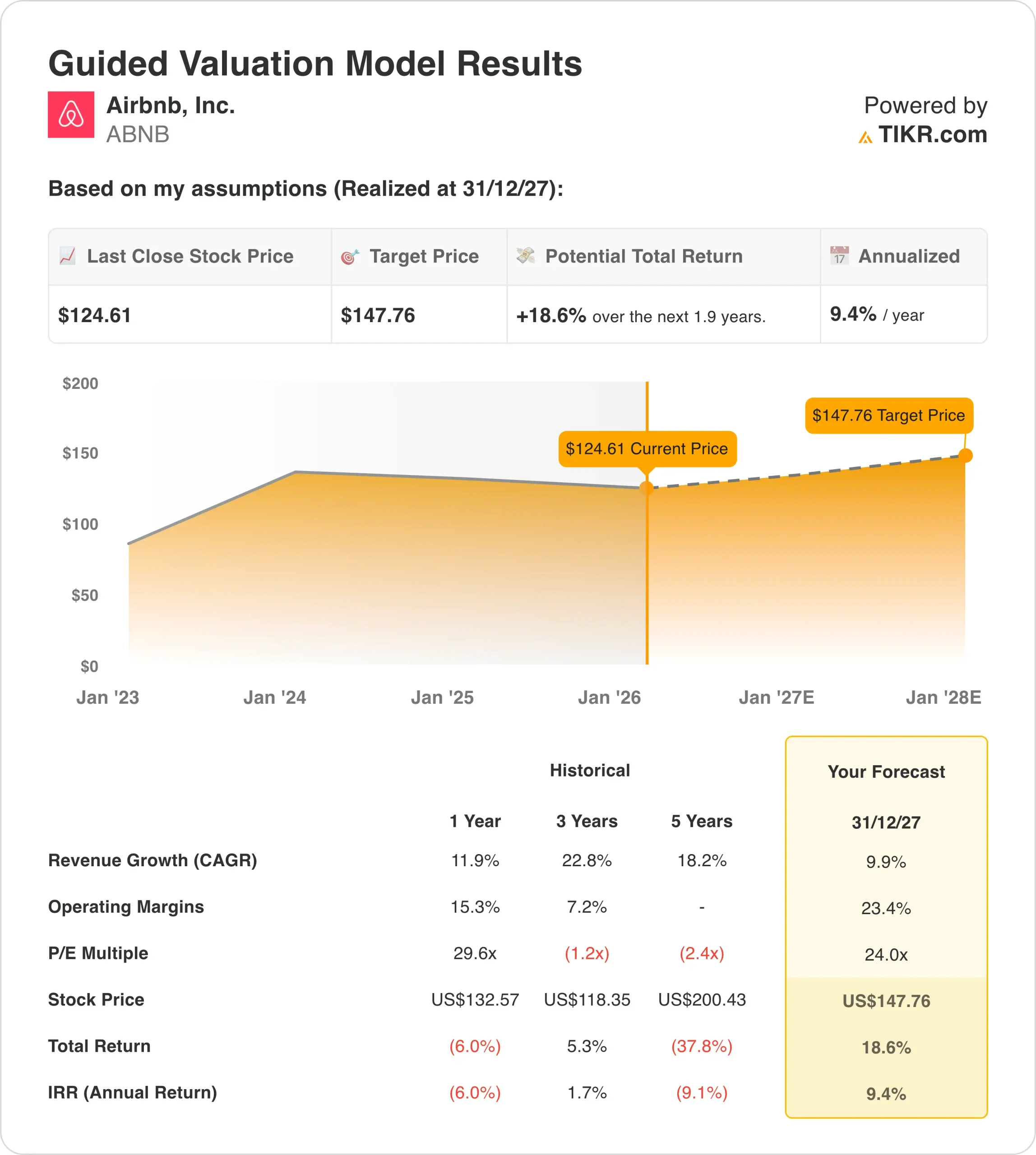

Market Dynamics: TRUMP and SUI Performance

While DeepSnitch AI captures significant momentum, other projects like Official Trump and Sui navigate their own market dynamics. Official Trump, a politically themed cryptocurrency, has experienced sideways trading, hovering around the $3.50 mark and testing its $3.02–$3.64 range. Despite mixed signals from whale wallets—some accumulating, others reducing exposure—and slightly negative funding rates indicating cautious futures positioning, the project shows nascent signs of improving momentum. Its Relative Strength Index (RSI) is trending higher at 39, and the MACD (Moving Average Convergence Divergence) has displayed a bullish crossover. However, it requires the RSI to breach 50 to confirm sustained strength, with a failure to break past $3.64 potentially leading to a retreat towards $3.02, as observed by Bitget. Meanwhile, Sui, a blockchain platform, is trading near $0.94 and is benefiting from institutional interest. The introduction of spot ETFs like Grayscale Investments' GSUI and Canary Capital's SUIS offers regulated exposure coupled with staking yield. These ETFs acquire spot SUI, effectively removing tokens from circulation. Given that over 70% of the supply is already staked, leaving a tight liquid supply, steady ETF demand could significantly amplify price movements. Technically, Sui has formed a descending wedge, reclaiming key support levels and compressing under $1.05. A breakout above this threshold could trigger a significant expansion, with support levels at $0.88–$0.90 and $0.82 respectively, as reported by Bitget. These contrasting performances highlight the diverse factors influencing various crypto assets, from fundamental utility and institutional adoption to speculative interest and technical indicators.

Analysis: The Broader Implications of AI Integration in Crypto

The strategic pivot by Bitcoin miners towards AI and high-performance computing, as exemplified by MARA Holdings, signifies much more than a mere diversification of assets; it points to a fundamental reshuffling of value within the digital asset ecosystem. This shift is a direct response to the inherent volatility and diminishing returns of raw cryptocurrency mining post-halving. By funneling capital and computational power into AI, these entities are not just seeking new revenue streams but are positioning themselves at the nexus of two of the most transformative technologies of our age. This integration has several profound implications. Firstly, it provides a more stable and potentially less volatile revenue model for companies traditionally exposed to the unpredictable swings of crypto prices. AI services, cloud computing, and data processing offer more predictable demand and pricing structures. Secondly, it could accelerate the development and adoption of AI within blockchain frameworks, leading to genuinely innovative applications beyond financial transactions. Imagine decentralized AI models, AI-powered smart contracts, or blockchain-secured AI data markets. This merging of technologies also raises important questions about energy consumption and sustainability, as both mining and advanced AI training are energy-intensive processes. However, the move into AI by established players like MARA indicates a long-term vision where technological synergy, rather than isolated niches, will drive future growth and institutional capital allocation. This trend suggests a future where the lines between traditional tech and crypto blur further, creating a hybrid industry with robust infrastructure and diverse utility.

A Viral Monkey's Story: Humanity and Compassion in a Digital Age

In a fascinating juxtaposition to the financial machinations of the crypto world, another story capturing global attention speaks to a different kind of value: compassion and connection. The tale of Punch, a baby macaque from Ichikawa City Zoo in Japan, has flooded social media platforms, particularly X, offering a poignant counter-narrative to the hard-nosed pursuit of profit. Punch’s story began with hardship; separated from his mother at birth, he was hand-raised by zookeepers and given a stuffed orangutan for comfort. This image of the tiny macaque clinging to his plush toy resonated deeply with audiences worldwide, a universal symbol of vulnerability and the need for companionship. A more recent, "heartbreaking video" on X showed Punch being dragged by a larger monkey, sparking widespread distress and anger among viewers, as reported by ABP Live English. The zoo later clarified that the incident was likely a disciplinary action from the mother of another baby monkey Punch had tried to interact with, emphasizing Punch’s "resilience" and the natural social dynamics within macaque troops. This viral phenomenon even caught the attention of IKEA Japan, whose president, Petra Färe, visited the zoo and donated additional stuffed animals, recognizing Punch’s beloved companion as their Djungelskog plush toy. Beyond animal welfare, Punch’s journey has been leveraged by entities like Delhi Police, who used his story as a "call for compassion." In a touching social media post, they depicted a constable holding a monkey's hand, echoing Punch’s need for support and conveying the message, "everyone needs someone & we're always here for you. Dial 112," as documented by India Today. This narrative, while seemingly disparate from crypto market news, underscores the power of digital platforms to disseminate stories that evoke empathy and foster connection, reminding us that alongside technological innovation, human (and even animal) narratives continue to capture collective imagination and influence societal discourse.

Looking Ahead: The Intertwined Future of AI and Crypto

The ongoing developments indicate a future where the lines between artificial intelligence and cryptocurrency will become increasingly blurred. The strategic investments by major players like MARA Holdings are a strong signal that the speculative era of crypto is giving way to a period focused on utility, infrastructure, and sustainable business models. For investors, this shift presents both challenges and opportunities. Identifying projects like DeepSnitch AI, which offer tangible utility powered by AI, will be crucial. The success of such projects will likely hinge on their ability to deliver real-world value and integrate seamlessly into existing digital ecosystems. Simultaneously, the increasing maturity of the crypto market, including the advent of regulated products like spot ETFs for assets such as Sui, indicates a growing acceptance and institutionalization of digital assets. While market volatility will invariably persist, the underlying trend points towards a more robust, integrated, and application-driven landscape where AI acts as a powerful catalyst for innovation and growth within the blockchain space. The coming years will reveal whether this strategic pivot by Bitcoin miners and the rise of AI-driven protocols like DeepSnitch AI will truly define the next crypto cycle, transforming the sector into a powerhouse of advanced computing and intelligent applications.