Tucson, Arizona, is on the precipice of what forecasters are describing as a potentially historic warming trend, with temperatures expected to climb steadily throughout the week and threaten record highs by the upcoming weekend. This significant meteorological event, marked by consistently clear skies and a complete absence of rain in the forecast, signals a notable deviation from typical late-winter conditions. While residents prepare for an unseasonably hot spell, a different kind of, albeit equally significant, shift is underway in the technology sector, with massive capital flowing into artificial intelligence, fundamentally reshaping industries from cloud computing to cryptocurrency. The confluence of these events highlights a world in rapid flux, where climatic patterns diverge from historical norms and technological innovation drives unprecedented reconfigurations of economic landscapes.

Background and Context: Tucson's Climate and the AI Investment Boom

Arizona's Sonoran Desert climate is renowned for its intense heat, particularly during the summer months, but a late-February warming trend threatening daily records is less common. Historical data for Tucson typically shows average high temperatures in late February hovering in the mid-to-high 60s, with nights often dipping into the low 40s. The forecast of sustained 80-degree-plus weather, peaking near 87 degrees, represents a significant anomaly. This extended period of dry, warm weather without any precipitation signals a departure from typical seasonal patterns and raises questions about long-term climate shifts. According to KOLD, the "First Alert Forecast" indicates a rapid escalation of temperatures, moving from the low 70s to the upper 80s within a week, coupled with increasingly breezy conditions. This localized forecast resonates with broader discussions about global climate patterns and the increasing frequency of extreme weather events, making monitoring such trends critical for areas like Tucson.

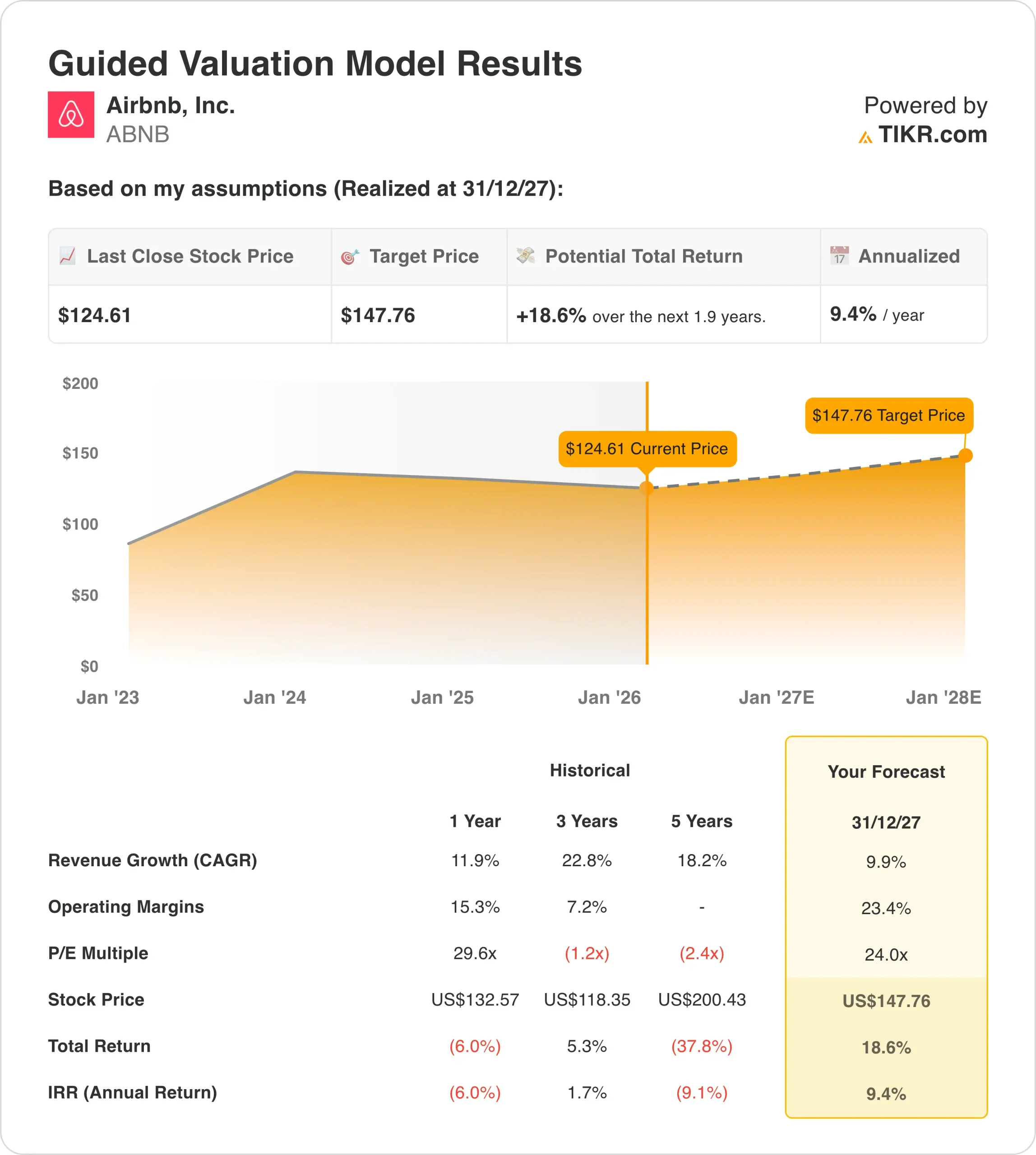

In parallel, the tech sector is witnessing an unprecedented surge of investment into artificial intelligence. The year 2025 alone saw over $1.5 trillion channeled into AI initiatives, signaling a pivotal shift in technological development and economic priorities. This capital influx is not merely about creating new AI tools but also about integrating AI into existing infrastructure and industries, leading to broad market reconfigurations. This massive investment underscores a collective belief in AI's transformative power, positioning it as the next major technological frontier. Companies across various sectors are now strategically aligning themselves to leverage AI capabilities, from enhancing operational efficiencies to developing entirely new service offerings. This includes a significant pivot within the cryptocurrency mining industry, which is now actively diversifying into AI and high-performance computing, searching for new revenue streams and applications beyond traditional crypto mining.

Key Developments: Tucson's Soaring Temperatures and Crypto's AI Embrace

The immediate concern for Tucson residents is the unfolding weather phenomenon. The KOLD forecast paints a clear picture: Sunday will kick off with a high of 77 degrees, swiftly escalating to 81 on Monday, 83 on Tuesday, and 84 by Wednesday. The latter half of the week promises even higher temperatures, with Thursday reaching 85 degrees and both Friday and Saturday hitting a scorching 87 degrees. These temperatures are not just warm for the season; they "threaten records" and are accompanied by persistently dry conditions, with no rain expected in the "foreseeable future." Winds are also expected to ramp up tonight through tomorrow, with gusts reaching 25-30 mph, potentially exacerbating fire risks in the currently dry environment. This sustained period of abnormal warmth could have various implications, from increased energy consumption for cooling to heightened vigilance against brush fires, necessitating careful monitoring by local authorities and residents alike. The consistent upward trend and the longevity of this warm spell are distinguishing features, making it a "potentially historic warming trend" rather than a fleeting weather anomaly.

Simultaneously, the cryptocurrency market is undergoing a profound transformation driven by the integration of artificial intelligence, as detailed in recent Bitget crypto market news. Bitcoin miners, facing tightening margins post-2024 halving and increased network difficulty, are strategically diversifying their operations. A prime example of this pivot is MARA Holdings, a significant player in Bitcoin mining, which has acquired a 64% stake in Exaion, a French computing infrastructure operator. This move, initially agreed with EDF Pulse Ventures, thrusts MARA into the artificial intelligence and cloud services arena, leaving French energy giant EDF as a minority shareholder. NJJ Capital is also set to take a 10% stake in MARA France as part of this partnership. This acquisition represents a broader trend where cryptocurrency capital is accelerating towards projects that blend blockchain technology with real AI utility. The focus is shifting from pure mining to leveraging existing computing infrastructure for high-performance computing tasks critical for AI development. This strategic redirection is not merely about survival but about seizing new growth opportunities within the burgeoning AI sector, illustrating a dynamic evolution within the crypto industry where innovation and adaptability are key.

Further highlighting this trend, the crypto market is seeing increased interest in AI-centric protocols like DeepSnitch AI. This platform, according to Bitget, is emerging as a "potential top investment for 2026" due to its suite of AI agents designed to assist investors. These agents perform critical functions such as tracking whale wallets, scanning smart contracts for vulnerabilities, monitoring the latest crypto market news, and flagging risks, thereby providing sophisticated analytical tools to investors. The appeal of DeepSnitch AI lies in its ability to offer advanced insights without requiring deep technical knowledge from its users, making it accessible to a wider audience. This focus on "real AI use cases" within the crypto space is attracting significant capital from major investors and "whales," positioning DeepSnitch AI ahead of other tokens like Official Trump and Sui in terms of recent market sentiment and investment flow. While Official Trump showed sideways trading with mixed whale behavior and Sui gained traction through new spot ETFs offering regulated exposure with staking yield, DeepSnitch AI's direct integration of AI utility for market analysis stands out as a driving force in the current crypto landscape.

Analysis: What This Means

The concurrent narratives of Tucson's potential record-breaking heat and the crypto sector's aggressive pivot to AI, while seemingly disparate, underscore a broader theme of adaptation and redefinition in the face of evolving conditions. For Tucson, a "potentially historic warming trend" isn't merely a weather report; it's a stark reminder of the accelerating impacts of climate change. A sustained week of temperatures in the mid-to-high 80s in late February could strain local resources, from water management to public health systems, by potentially increasing heat-related illnesses and energy demands. It serves as a localized manifestation of global climate patterns, pushing municipalities to re-evaluate infrastructure and emergency preparedness for increasingly unpredictable weather events. This particular forecast, coming early in the year, could also influence local ecosystems, potentially impacting plant budding cycles or insect populations, further signaling a subtle yet significant shift in the region's natural rhythm. The long-term implications for agriculture, water security, and urban planning in a desert environment are profound and warrant sustained attention beyond this immediate forecast.

In the financial and technological realm, the massive capital infusion into AI, particularly by former Bitcoin mining giants like MARA Holdings, signals a significant paradigm shift. This isn't just about diversification; it indicates a recognition that the computational power once dedicated solely to securing blockchain networks can be more profitably and sustainably deployed in the burgeoning field of artificial intelligence. The tightening margins for Bitcoin miners, exacerbated by the 2024 halving and rising network difficulty, have forced a critical re-evaluation of business models. MARA's acquisition of a majority stake in Exaion positions it at the forefront of high-performance computing services, directly capitalizing on the insatiable demand for AI infrastructure. This move could set a precedent for other miners, transforming a sector traditionally linked to energy-intensive proof-of-work into a key enabler of AI innovation. The narrative around DeepSnitch AI further exemplifies this shift, showcasing how AI is being directly integrated into investment strategies, moving beyond speculative trading to provide enhanced analytical capabilities and risk mitigation. This evolution suggests a maturing crypto market that is increasingly seeking real-world utility and robust technological foundations, rather than solely relying on speculative interest.

The intertwining of these events illustrates a global landscape where both environmental and technological forces are reshaping human society. The climate crisis demands proactive adaptation and mitigation strategies, as evidenced by the need for communities like Tucson to prepare for unseasonable heat. Simultaneously, the rapid advancement and adoption of AI are creating new economic opportunities and challenges, compelling industries to innovate or risk obsolescence. The movement of vast sums of capital into AI infrastructure underscores a societal bet on future technological capabilities, expecting AI to deliver solutions across myriad sectors. For individual investors, the emergence of platforms like DeepSnitch AI represents a democratization of advanced analytical tools, potentially evening the playing field in complex markets. However, it also highlights the increasing sophistication and complexity of financial instruments, requiring greater understanding and due diligence from participants. Both the escalating temperatures and the AI revolution symbolize eras of accelerated change, necessitating informed responses from individuals, businesses, and governments.

Additional Details: Forecast Specifics and Crypto Market Dynamics

Digging deeper into Tucson's forecast, the consistency of the warming trend is noteworthy. According to KOLD, the daily progression of temperatures is remarkably linear: from a morning low of 48 and high of 77 on Sunday, it steadily climbs to morning lows of 56-57 and highs of 87 by Friday and Saturday. This sustained warmth, accompanied by mostly sunny conditions and increasing breezes, suggests a strong high-pressure system dominating the region. The absence of any rain in the long-range forecast exacerbates concerns about dryness and potential fire hazards, particularly as the winds pick up. While the immediate health risks often associated with extreme summer heat waves might be mitigated by the relatively lower absolute temperatures, an unseasonable extended period of mid-to-high 80s can still pose challenges for vulnerable populations and require precautionary measures such as hydration and avoiding prolonged outdoor exposure during peak heat for activities. Public awareness campaigns to conserve water and prevent wildfires may become increasingly pertinent as this warm, dry spell continues.

On the cryptocurrency front, the strategic maneuvers by companies like MARA Holdings and the rise of DeepSnitch AI speak volumes about the current market sentiment and future trajectories. MARA's 64% acquisition of Exaion, a French computing infrastructure operator, demonstrates a clear shift from primarily Bitcoin mining to a more diversified portfolio that includes artificial intelligence and cloud services. This move is not an isolated incident but rather a reflection of a "broader trend of Bitcoin miners diversifying into AI and high-performance computing as mining margins tighten," as reported by Bitget. The collaboration with EDF Pulse Ventures and NJJ Capital further solidifies MARA's position in the European AI infrastructure market, indicating a well-thought-out expansion strategy capitalizing on the global demand for AI computational power. This financial engineering allows MARA to mitigate the risks associated with the volatile nature of cryptocurrency mining revenues, while simultaneously tapping into the explosive growth potential of the AI sector. The transaction also highlights how traditional energy infrastructure providers and investment funds are actively participating in and supporting the growth of technological innovation in the digital asset space.

The performance of DeepSnitch AI against other tokens in the market further illustrates investor confidence in AI-driven utility. While Official Trump and Sui certainly have their own market dynamics – Official Trump displaying sideways movement with cautious investor positioning despite a bullish MACD, and Sui benefiting from new spot ETFs and tight liquid supply – DeepSnitch AI's ascent is directly tied to its practical applications. The platform's five AI agents are designed to track "whale wallets," "scan smart contracts," "monitor the latest crypto market news," and "flag risks," functionalities that cater directly to the sophisticated needs of modern investors. This focus on providing "better information before risking your money" resonates with major investors, positioning DeepSnitch AI as a significant player in the evolving blockchain-AI nexus. Developers are clearly responding to market demands for tangible utility beyond speculative value, ensuring that only projects with clear, robust use cases gain significant traction and investment, especially from "whales and major investors," as identified by Bitget. This trend suggests that the future of cryptocurrency, at least in certain segments, will be inextricably linked to the capabilities and applications of artificial intelligence.

Looking Ahead: Future Implications and What to Watch

For Tucson, the extended warming trend serves as an early indicator for the rest of the year. Residents and city planners will need to monitor how this unseasonable heat affects water resources, public health initiatives, and emergency services. The potential for an elevated fire season will also be a critical concern, particularly if the dry conditions persist into the spring. This forecast may compel a renewed focus on climate resilience and adaptation strategies within the Sonoran Desert region. On the economic front, the massive shift in the crypto industry towards AI infrastructure, exemplified by MARA Holdings and platforms like DeepSnitch AI, suggests a redefinition of value in the digital asset space. Investors will be keen to observe how these AI integrations translate into sustained profitability and innovation. The success of these ventures could pave the way for further mergers and acquisitions, blurring the lines between traditional tech and blockchain industries. The competitive landscape for AI-driven crypto utilities will intensify, making fundamental project utility and robust AI integration paramount for long-term viability. The coming months will be crucial in establishing whether this AI pivot represents a lasting transformation or a temporary market trend, but all indications point towards a profound and permanent reorientation.