China's New AI Billionaires Challenge US Tech Dominance in Geopolitical Race

A new generation of Chinese AI entrepreneurs is amassing billions, fueled by state-backed tech independence drives and challenging established Silicon Valley giants, amidst escalating US-China tensions.

In a dramatic shift echoing the intensifying geopolitical rivalry between Washington and Beijing, a new cohort of Chinese artificial intelligence entrepreneurs is rapidly accumulating immense wealth, transforming the global tech landscape. These "quiet geeks," as they are sometimes dubbed, are collectively worth over $100 billion, directly fueled by China’s aggressive push for technological independence. Firms like MiniMax Group Inc. and innovators such as Yan Junjie, Liang Wenfeng of DeepSeek, and Wang Xingxing of Unitree Robotics are not merely building successful businesses; they are at the vanguard of China’s national ambition to dethrone US tech supremacy, particularly in the critical field of AI. Their rise symbolizes a fundamental reorientation of wealth creation in China, deeply intertwined with the state's strategic imperative to become self-reliant in advanced technologies.

Background: The Shifting Sands of China's Tech Ambition

For decades, China's tech sector was often characterized by its ability to emulate and adapt Western innovations, sometimes with a significant edge in scale and localized execution. However, the last few years have witnessed a deliberate and state-mandated pivot towards indigenous innovation, particularly in strategic sectors like artificial intelligence and semiconductors. This shift intensified as geopolitical tensions with the United States escalated, leading to export controls and sanctions aimed at curtailing China's access to advanced Western technology. Beijing responded with massive investments and policies designed to foster domestic champions and reduce reliance on foreign components and intellectual property. The current wave of AI billionaires is a direct outcome of this national strategy, signaling a new era where domestic technological prowess, rather than mere market dominance, is the primary driver of success and wealth. Unlike the flamboyant "rock-star CEOs" of yesteryear, these new tycoons operate with a distinct low-profile demeanor, a strategic choice that reflects the dual pressures of potential US sanctions and domestic government scrutiny over excessive displays of wealth, as reported by Bloomberg.com.

Main Developments: A New Breed of AI Tycoons

The landscape of China's tech elite has fundamentally transformed, giving rise to a generation of AI innovators who are not only building multibillion-dollar companies but also spearheading the nation's quest for technological sovereignty. Yan Junjie, the 36-year-old founder of MiniMax Group Inc., exemplifies this new trend. Four years ago, his vision for a multimodal AI company—capable of processing text, images, audio, and video concurrently—was met with skepticism, even dismissal, from China's established internet giants and investors. Today, MiniMax is valued at billions, making Yan a billionaire and a key player in what Bloomberg.com describes as a "new wave of technological nationalism." Yan rigorously benchmarks his models against industry leader OpenAI, showcasing the ambition to not just compete but to potentially surpass global benchmarks.

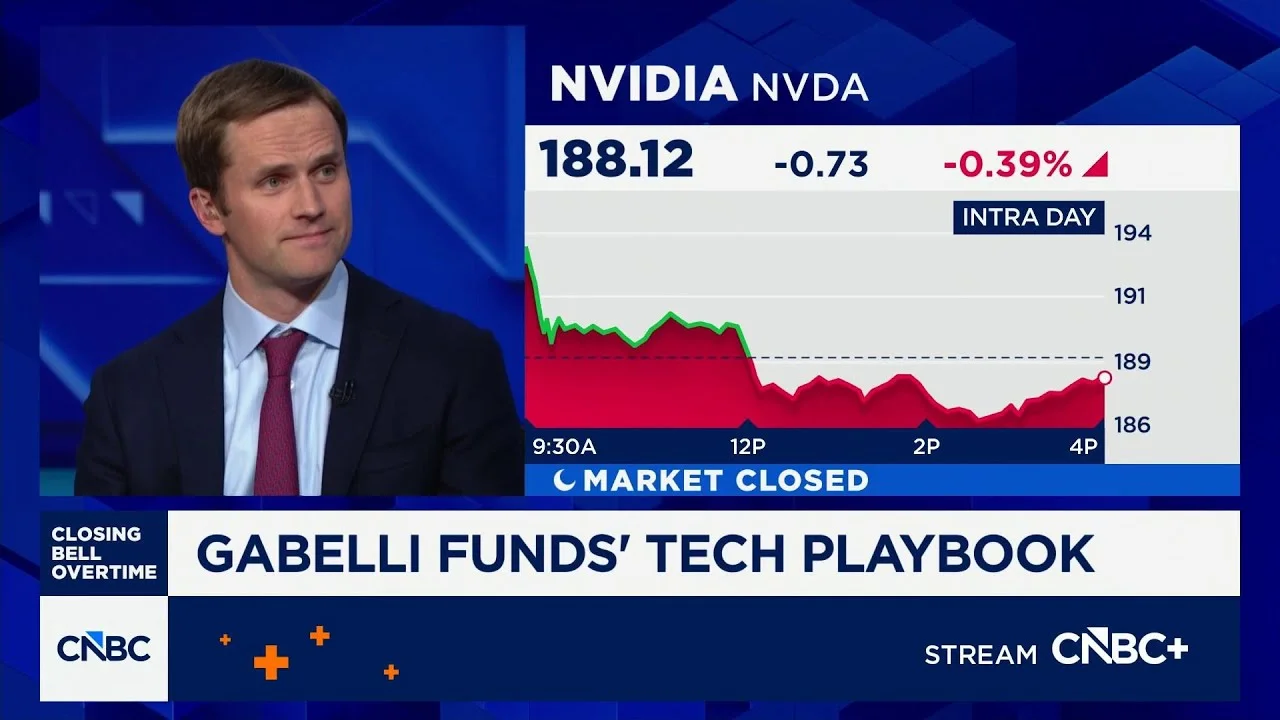

He is joined by other formidable figures like Liang Wenfeng, the millennial quant prodigy behind DeepSeek, and Wang Xingxing of Unitree Robotics, all pushing the boundaries of AI innovation. The expansion of this group is further evidenced by a flurry of Chinese AI firms going public, including MetaX Integrated Circuits Shanghai Co., founded by Chen Weiliang, and Moore Threads Technology Co., led by Zhang Jianzhong. These entrepreneurs and their peers have amassed a collective net worth of $100.5 billion, a figure that nearly rivals the $105 billion fortune of Microsoft co-founder Bill Gates, though still short of Jensen Huang’s $153 billion fortune largely driven by the AI hardware boom. Their ascent underscores how deeply wealth creation in China is now intertwined with the state’s strategic imperative for technological independence, particularly amidst the escalating tech and geopolitical rift with the United States.

A significant characteristic of this new cohort is their academic pedigree, with many hailing from elite institutions like Tsinghua University or the Chinese Academy of Sciences. Many have also spent years under state guidance, contributing to national research before venturing into entrepreneurship. For instance, Chen Tianshi of Cambricon Technologies Corp., a precocious talent who entered college at 16, spent six years as a researcher at a state academy before founding his AI chipmaker. His wealth has surged by over 800% since early 2024 to $21.5 billion, a growth directly facilitated by Beijing's aggressive "buy-local" policies that prioritize domestic technology. Another notable trend is the return of seasoned executives from major US tech firms. Zhang Jianzhong, a former Nvidia executive, established Moore Threads over five years, building it into a $45 billion company with the explicit goal of replacing the very chips he once sold. Similarly, Chen Weiliang, formerly a senior director at AMD, strategically recruited several ex-AMD colleagues to form MetaX. These individuals, once integral to American tech giants, have now become formidable competitors, leveraging their insights and expertise to advance China’s indigenous capabilities, as highlighted by Bloomberg.com. This mirrors global trends in advanced AI development, such as Stanhope AI’s efforts to create human brain-based AI, which recently raised $8 million, demonstrating a universal push for next-generation intelligence, as reported by UKTN, though with distinct national motivations.

Analysis: Beyond the Language Models – The Geopolitical AI Race

The rise of China’s AI billionaires goes beyond mere economic success; it is a profound indicator of a fundamental global power shift, particularly in the realm of advanced technology. The shift from AI primarily focused on large language models (LLMs) to more dynamic, real-world adaptable systems, as exemplified by companies like Stanhope AI developing "Real World Model" products, underscores a broader technological evolution. Stanhope AI's approach, aiming to mimic the human brain's ability to understand context, uncertainty, and physical reality for applications like autonomous drone piloting, represents the cutting edge of AI development globally (UKTN). China's investment in its own AI champions, particularly those in multimodal AI and chip design, reflects a keen understanding that control over foundational AI infrastructure, from hardware to advanced algorithms, is paramount for national security and economic future. This isn't just about building better software; it's about owning the entire technological stack, largely insulating itself from external pressures and restrictions.

The discreet nature of these new Chinese tech magnates, a stark contrast to the previous generation's flamboyant leaders like Jack Ma, is a critical analytical point. This calculated low profile by figures like Chen Tianshi and Liang Wenfeng is a direct response to the twin threats of US government sanctions and the Chinese regulatory crackdown on conspicuous wealth. It signifies a maturation of China's tech ecosystem under immense geopolitical pressure. Success is no longer purely about market capitalization but also about alignment with national strategic goals and navigating a complex political landscape. This environment fosters a different kind of innovation—one that is deeply intertwined with state objectives and less susceptible to the whims of global capital or Western influence. Ultimately, the rapid wealth accumulation by these AI leaders underscores that the AI race is not just a technological competition, but a geopolitical one, where economic power is increasingly synonymous with technological self-sufficiency and strategic control over emerging frontiers.

Additional Details: Elite Education, State Guidance, and Strategic Returns

The common thread among many of China’s new AI billionaires is their elite educational background, often from prestigious institutions like Tsinghua University, colloquially known as China's MIT, or the Chinese Academy of Sciences. This academic pedigree provides a solid foundation in cutting-edge research and engineering, crucial for developing sophisticated AI technologies. Moreover, many of these entrepreneurs have spent considerable time working directly or indirectly under state guidance before launching their startups. Chen Tianshi of Cambricon, for example, dedicated six years as a researcher at a state academy, implying a deep understanding of national priorities and perhaps even direct contributions to state-backed projects before transitioning to the private sector. This background fosters a tight-knit ecosystem where academic research easily translates into commercial applications that align with national objectives.

The financial success of these companies is intrinsically linked to government policies. Beijing's aggressive "buy-local" mandates, designed to boost domestic champions in critical tech sectors, have directly fueled the valuations and wealth of these firms. Chen Tianshi's Cambricon Technologies, an AI chipmaker, has seen his wealth surge by over 800% since early 2024, reaching $21.5 billion—a testament to the effectiveness of these protectionist and incentivizing policies (Bloomberg.com). This state-backed growth model offers a distinct advantage over competitors who rely solely on market forces and private investment. Furthermore, the return of veteran executives from US tech giants like Nvidia and AMD has been a game-changer. These individuals bring invaluable expertise, networks, and understanding of global industry standards and competitive strategies back to China. Zhang Jianzhong, a former Nvidia executive, not only built Moore Threads into a $45 billion company but did so with the explicit aim of producing chips that could replace those he once helped sell. This strategic recruitment of experienced talent underscores China's methodical approach to rapidly close technological gaps and establish market leadership, transforming former collaborators into formidable rivals.

Looking Ahead: The Enduring AI Arms Race and Global Impact

The meteoric rise of China’s AI billionaires signals a deepening, long-term commitment by Beijing to dominate the AI landscape, fundamentally reshaping global technological and economic power dynamics. What we are witnessing is not a temporary surge but a sustained strategic effort, bolstered by massive state investment and a focused industrial policy. The continued growth of multimodal AI, exemplified by MiniMax, and advancements in brain-inspired AI, as explored by Stanhope AI (UKTN), will be critical battlegrounds. For global stakeholders, including businesses and governments, this means a future with increasingly bifurcated tech ecosystems, potentially leading to diverging standards and less interoperability. The quiet effectiveness of these new Chinese tech leaders, combined with their state backing, suggests an enduring AI arms race that will redefine geopolitical influence and economic competitiveness for decades to come, demanding vigilance and strategic adaptation from all players on the global stage.

Related Articles

Global Markets Brace for Earnings as Brain-Inspired AI Startup Eyes Robotic Revolution

Stock futures nudged higher amidst volatile markets after tech losses, as a UK-based AI startup secures $8M to develop human brain-like AI for robotics and autonomous drones.